Loading component...

At a glance

- The events of the past few months have meant that digital transformation has gone from advisable to non-negotiable.

- However, survey data reveals that small and medium-sized businesses in Australia perceive digital transformation as too difficult or too expensive, and lag their counterparts in Asia.

- This need not be the case, and early adopters of digital technology argue that the current environment presents an opportunity for ambitious change that can generate long-term returns.

By Nigel Bowen

One of the unexpected side-effects of the pandemic has been the rapid acceleration of the digital transformation journey for many businesses. However, there is great disparity between the starting points in the race to digitise between Australian small and medium-sized enterprises (SMEs) and their Asia-Pacific counterparts.

CPA Australia’s most recent Asia-Pacific Small Business Survey indicates that, pre-pandemic, SMEs in Asia were “much more likely to be undertaking activities associated with growth” than their counterparts in Australia and New Zealand. In particular, Asian SMEs were found to be much more focused on “new payment technologies, social media and improving customer satisfaction”.

In contrast, many Australian SMEs perceive investment in technology as too overwhelming, too expensive, or both. Yet this need not be the case. Three case studies of early and vigorous tech adopters, from Australia and overseas, show that investing in technology can generate returns on investment in spades.

Early adopters' perspective

The term may only have entered the lexicon in recent years, but Murray Wyatt FCPA argues that Australian accountants have been “digitally transforming” for at least four decades. When Wyatt started at Morrows Group in 1981, he found himself elbow-deep in “microcomputers and floppy disks”. One of his first big projects involved helping a manufacturing client install a Wang Laboratories computer that automated basic bookkeeping tasks.

Wyatt, who is now the director and chairman of Morrows, believes both regulatory requirements and competitive pressures incentivise the majority of Australian firms to be early, or at least early majority, tech adopters.

“If the ATO [Australian Taxation Office] requires tax returns to be lodged electronically, then that forces even the stragglers to embrace the necessary technology,” he points out. “Even before the step change of COVID-19, firms that hadn’t embraced electronic document signing, videoconferencing and remote working were struggling to attract and retain good clients and staff,” he continues.

"How is a firm renting three floors of a CBD office building going to compete with a similar-sized firm that only rents one office in the same building and has staff working remotely?"

“Morrows switched to cloud-based platforms and software such as Microsoft 365 and Xero, and issued all our staff with Microsoft Surface Pros years ago. That meant it was business as usual when we closed the office and told our 150-strong team to work from home. Many of them will continue to work from home even after the shutdowns end.”

Wyatt argues that digital transformation has now gone from advisable to non-negotiable.

“At this juncture, any firm that isn’t adopting technology is going to end up with cost structures that render it uncompetitive,” he says.

“How is a firm renting three floors of a CBD [central business district] office building going to compete with a similar-sized firm that only rents one office in the same building and has its staff working remotely?”

Catching up just in time

Nowadays, Vickie Fan FCPA is something of a Hong Kong digital transformation celebrity. However, the star of the recent promotional video for Canon’s Therefore document management system (DMS) confesses she was late to the automation party. When Fan started her career in 1999, the only digital device she had unimpeded access to was a calculator.

“There was a computer, but that had to be shared by many of us in the office,” she laughs. The digital transformation of Fan, Chan & Co. proceeded at a leisurely pace until 2018. That’s when Fan – by then the firm’s managing partner – went on a “SaaS splurge”.

“The firm had grown and systems that had, more or less, worked previously were breaking down,” she explains. “Take working with paper documents – the time and money chewed up in processing and storing those documents was bad enough. But what became intolerable was documents being misfiled. Even if 999 out of every 1000 documents are put in the right place, you have a major problem with that error rate once you’re dealing with tens of thousands of documents.”

In addition to Canon’s Therefore DMS, Fan has invested in Xero’s practice management software, as well as its MyWorkpapers paperless workpaper solution, all in the past 18 months. She is keeping an eye on artificial intelligence (AI) and blockchain products, but waiting until those technologies become more mature before making any buying decisions.

Long-term plans

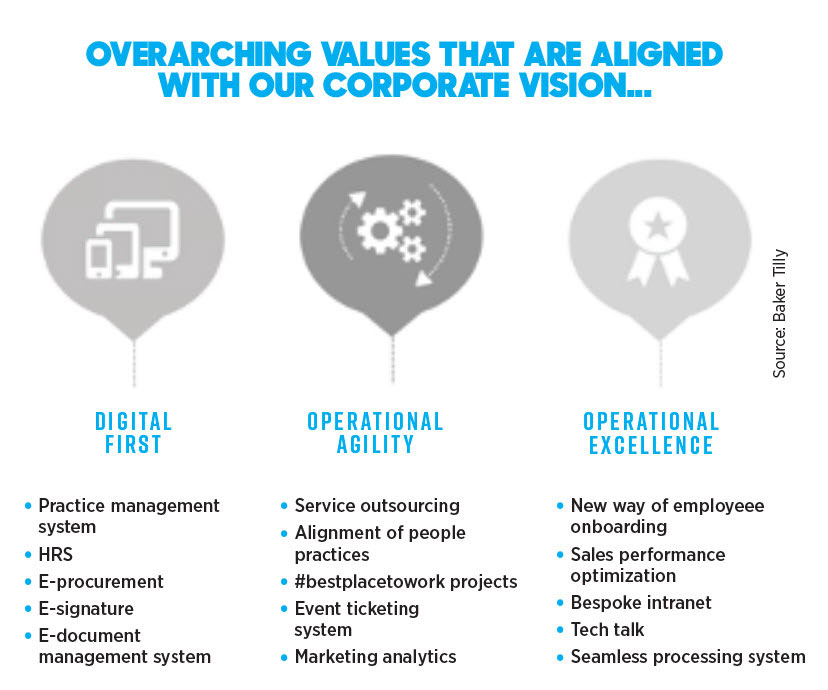

In 2018, the Malaysian office of Baker Tilly embarked on what was then envisioned as a three-stage, six-year digital transformation journey.

“Thankfully, we’d ticked all the boxes on ‘Digital First’ by the time COVID-19 arrived in Malaysia,” says Andrew Heng FCPA, group managing partner at Baker Tilly Malaysia and a past president of CPA Australia’s Malaysia Divisional Council.

“Given what’s happened in 2020, I suspect we’ll fast-track the ‘Operational Agility’ and ‘Operational Excellence’ stages.”

Heng echoes Wyatt and Fan when questioned about the importance of digital transformation.

“No doubt there are some senior partners in firms all around the world who can get away with delegating any tech stuff to their secretary, but those individuals are reaching the end of their careers,” Heng observes.

“If you’re an old-school manager, good luck finding any graduates who are willing to spend their first couple of years on the job filing documents and manning the photocopier. If you’re a late adopter working for a digitally savvy manager, your situation is even direr. If your boss likes to communicate via WhatsApp, and you can’t work out how to install it on your laptop, you’re not going to be around for long.”

CPA Library resource:

Investor-ready or a renovator's delight?

Fan, Heng and Wyatt have a stark warning for SMEs hoping they can avoid having to learn any new tricks as the fourth industrial revolution gathers steam: adapt now or brace for trouble later.

“If you’re looking to sell, you’ll either be putting an investor-ready or a ‘renovator’s delight’ business on the market,” Wyatt says. “If it’s the latter, you can expect less interest from buyers and a lower price.”

Fan is unsure that she’d buy an untransformed firm, even if it were going for a song. “If I were going to consider buying such a business, I’d need to make sure the firm’s staff and customers were open to systems and procedures being updated,” she says.

Heng argues that, whether someone is looking to sell a firm or hand it on, they have a responsibility to pass it over in good shape. “The world is changing fast,” he says. “Look at how videoconferencing and remote working arrangements went mainstream almost overnight earlier this year. Any accountant who doesn’t want to adapt to technological change should consider making a career change or retiring.”

Lessons in digital transformation

Don't let a good crisis go to waste

In ordinary circumstances, people resist change. Given the extraordinary circumstances created by the pandemic, Fan, Heng and Wyatt all argue that business owners and senior managers have a rare window of opportunity to drive ambitious change programs.

Sell the upsides early and often

“I lost a couple of staff when I began introducing SaaS products,” Fan says. “The software would have improved their work lives, but they obviously didn’t see it that way. That taught me the importance of making it clear to staff how new technology will make their life easier or more enjoyable. When I rolled out the document management system, I constantly pointed out how it was eliminating the tedious tasks created by paper documents. That meant I got buy-in from all my employees.

Try to back the right horse...

“There were many accounting software products to choose from in the early 2000s and no way of knowing which ones were going to become popular,” Wyatt observes. “Investing in, say, Solution 6, rather than MYOB, Xero or QuickBooks back then may have been unfortunate. It might turn out that, for instance, Xero becomes dominant and all the firms using MYOB and QuickBooks need to switch over.”

... But accept that you won't always make the right decision

Baker Tilly Malaysia recently spent RM200,000 (A$65,645) on cutting-edge HR software that was meant to set KPIs, deliver performance reviews and determine bonuses.

“On top of the upfront cost, the firm was also locked into paying monthly fees,” Heng sighs. “After we’d invested lots of time and money into purchasing and rolling out the system, it became apparent it would never deliver what it promised.”

Heng argues such misfires are unavoidable and often turn out to be valuable learning experiences. “We eventually found a new vendor and gave them detailed guidelines about what we did and didn’t want. That meant they were able to deliver excellent HR software at a much lower price than would have been the case if we hadn’t provided such a comprehensive brief,” he says.

“The reality is that you’re not going to get every technology call right. The only tip I can offer around minimising bad investments is to involve some younger staff in the purchasing decision. They tend to be more tech savvy and more likely to identify potential future problems.”

Focus heavily on customer experience

“People say, ‘Data is the new oil’, but I think it’s more accurate to say, ‘Client experience is the new oil’,” Wyatt says. “I recently flew to the US to visit my son. When I got out of the airport, I walked past the taxis and typed my son’s address into my Uber app. I didn’t have to worry about communicating with the driver or obtaining local currency. The entire experience was frictionless.”

That’s the kind of effortless customer experience accountants’ clients will soon be conditioned to expect, predicts Wyatt.

“Pretty soon, clients aren’t going to want the hassle of travelling into their accountant’s office for a face-to-face meeting,” he says. “They are certainly not going to uncomplainingly pay large fees when they don’t understand what value has been delivered.

They are going to expect their accountant to have captured and safely stored their financial data. They are going to expect to be able to e-sign any paperwork with a couple of taps on their smartphone. And they are most definitely going to expect their accountant to be able to provide granular data about how they are making and saving them money.”