At a glance

By Rod Spicer, associate director, Accountancy Insurance and Roman Kaczynski, director, Accountancy Insurance

When an audit hits, it is often due to a specific crackdown by the Australian Taxation Office (ATO) or other state and federal government revenue authorities.

Your clients may also be selected for an audit using a variety of data matching or other artificial intelligence sources used to assist in initiating audit activity of their lodged returns.

Due to the COVID-19 pandemic, 2020 saw a temporary lull in some of the ATO and other state and federal government revenue authorities’ usual audit activity levels. However, data shows that overall audit activity was still prevalent.

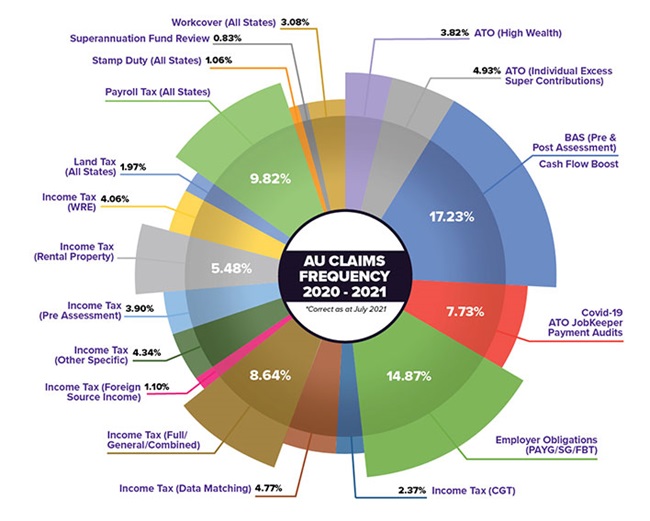

The below pie chart shows the distribution of Audit Shield claims activity in Australia.

In the 2020-2021 financial year, the five most frequent claim types among accounting firms offering Audit Shield in Australia were BAS audits and reviews (pre- and post-assessment), employer obligations audits and reviews (PAYG/SG/FBT), payroll tax investigations (all states), income tax audits and reviews (full/general/combined), and COVID-19 JobKeeper Payment audits and reviews.

For detailed insights into the drivers behind these claim types see: www.accountancyinsurance.com.au

Audit activity outside of the accountant’s control

Accountants may think that they don’t need to worry about tax audit insurance because they always take the conservative approach when preparing their client tax returns and, as a result, they are not on the ATO audit radar.

However, more than 59 per cent of the audit activity recorded in 2020-2021 was for claim types where the taxpayer or a bookkeeper may have prepared the lodged returns or managed the employer obligations compliance that were under audit, and the accountant had no involvement or hadn’t performed any review prior to the audit activity being instigated.

Frequency for claim types in 2020-2021 that accountants may never see – until it is too late – include:

- BAS audits and reviews – 17.23%

- Employer obligation audits and reviews – 14.87%

- Payroll tax investigations – 9.82%

- COVID-19 ATO JobKeeper Payment audits – 7.73%

- ATO excess super contributions – 4.93%

- WorkCover – 3.08%

- Land tax – 1.97%

How to reduce the impact of ATO audits and reviews

Audit Shield is an end-to-end tax audit insurance solution that covers accountants’ professional fees and the fees of experts, should your client be subject to ATO or other state and federal government revenue authorities’ initiated audit activity in relation to lodged returns or financial compliance obligations.

As official reviews, audits, investigations and inquiries of taxpayer-lodged returns and their taxation affairs in general continue to remain prevalent, the best course of action is to ensure that your accounting firm has a comprehensive tax audit insurance solution such as Audit Shield in place.

Thousands of accounting firms have made the decision to implement Audit Shield. These accounting firms benefit, as they are not out of pocket for the additional work they need to undertake on behalf of their clients. It’s a win-win and no net cost solution for your accounting firm.

To find out more visit: www.accountancyinsurance.com.au