At a glance

By Rod Spicer, associate director, Accountancy Insurance and Roman Kaczynski, director, Accountancy Insurance

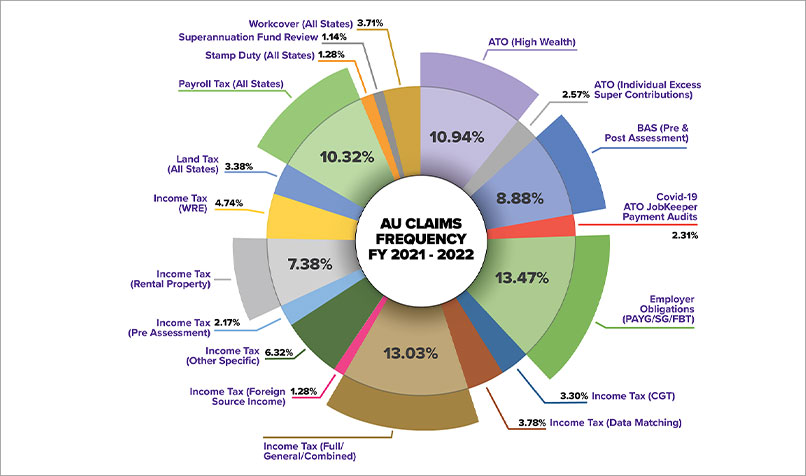

When an audit hits, it’s rarely reflective of the work put into preparing the return and is more likely due to a specific crackdown by the Australian Taxation Office (ATO) or other government revenue authorities. The pie chart shows the distribution of Audit Shield claims activity in Australia between 1 July 2021 and 30 June 2022*:

The Accountancy Insurance claims department continues to be busy processing claims from client accounting firms across Australia. Between 1 July 2021 and 30 June 2022, the six most frequent claim types among accounting firms offering Audit Shield in Australia were employer obligations audits and reviews (PAYG/SG/FBT), income tax (full/general/combined) audits and reviews, ATO (high wealth) audits and reviews, payroll tax investigations (all states), BAS audits and reviews (pre- and post-assessment), and income tax (rental property).

Detailed insights into the drivers behind these claim types are available on the Accountancy Insurance blog.

Audit activity outside the accountant’s control

In many ATO, state and federal government revenue authority audits and reviews (including three of the six highest claim types noted), the accountant becomes involved only after the government revenue authority-initiated audit activity has started.

To put that into perspective, nearly 50 per cent of the audit activity recorded by our claims department in the 2021-2022 financial year was for claim types where the taxpayer (your client) and/or a bookkeeper may have prepared the lodged returns or managed the employer obligations compliance that were under audit. Here is a breakdown of those figures:

- Employer obligation audits and reviews – 13.47%

- BAS audits and reviews – 8.88%

- Payroll tax investigations – 10.32%

- WorkCover – 3.71%

- ATO excess super contributions – 2.57%

- Land tax – 3.38%

- COVID-19 ATO JobKeeper payment audits – 2.31%

- Stamp duty – 1.28%

How to reduce the impact of ATO audits and reviews

The team at Accountancy Insurance has been perfecting tax audit insurance for almost 20 years. In that time, we have learned a thing or two about what accounting professionals are looking for to protect their firm and save their clients money.

One thing is clear, merely directing your clients to a broker’s website is not sophisticated, clever or innovative.

Besides offering broad policy coverage, our more than 3700 partnering accounting firms also experience the latest technological smarts and secure processes in the delivery and maintenance of their Audit Shield program.

We continue to develop and evolve our practice management integrations to make our renewal processes even more efficient, while continuously seeking out the best solutions available for business intelligence, security, compliance, tools and more.

Being serious about technology is one thing, but we also know the importance of genuine, hands-on assistance. Probably the most important thing for us is our focus on hands-on delivery. We still front our service offering with the simplicity of people who make it happen for you, all while you stay in control.

From initial sign-up, to your renewals, to claim finalisation, we keep you covered – year after year.

That’s just part of the Audit Shield experience.

To find out more visit: www.accountancyinsurance.com.au