Loading component...

At a glance

- Companies and economies batten down the hatches for what looks to be a year of economic uncertainty and slow growth.

- Trade tension, regulatory changes and technological disruption are some of the factors driving uncertainty in 2020.

- Amid slow growth, CEOs, accountants and finance professionals will be called upon to help businesses navigate challenges.

- Increased automation will provide greater scope for accountants and auditors in risk management, strategic thinking and creative problem-solving.

As Grace Ng CPA contemplates the business outlook for the next 12 months, the enormity of the challenges facing her company – SF Holding Company Limited, an integrated logistics service provider based in China – is not lost on her.

Trade tensions continue to buffet economic confidence in Asia and elsewhere.

Digital disruption poses the constant threat of tech-driven upstarts offering cheaper alternative services.

Tough regulatory changes in China will also put her finance team on notice to meet compliance standards.

“The Chinese consumer market still enjoys a strong growth rate due to expanding domestic consumption, but the market demand has shifted from higher-end to lower end products.” says Ng, the group CFO at SF Holding, which operates throughout China.

“For resource planning purposes, we don’t know for sure whether we’ll have strong growth in consumption and demand, or whether we will have weak growth, or whether such demand will come from the high end or the low end of the market.

"There are lots of uncertainties in the macro-economy, so we need to be very agile and responsive.”

Ng will closely monitor likely market trends for 2020 and beyond, while being wary of automatically assuming weak growth in the region.

“[The problem] if the market then picks up unexpectedly is that our resources won’t be adequate to meet demand, and we’ll lag behind our competitors.”

Economic challenges on the horizon

As economies slow around the world, the onus will be on CEOs, accountants and finance professionals to guide businesses of all sizes through stormy waters.

CPA Australia’s tenth annual Asia-Pacific Small Business Survey confirms that global trade tensions are likely to be the chief cause of a weakening in small business confidence.

The survey of small business owners in Australia, Mainland China, Hong Kong, Indonesia, Malaysia, New Zealand, the Philippines, Singapore, Taiwan and Vietnam reveals that small businesses that are growing strongly or that expect to grow strongly are far more likely to invest in technology, including new digital and online payment innovations.

They also focus on customer satisfaction, innovation and social media to better engage with and understand their customers.

Tan Wee Ko FCPA, the CFO and executive director of Singaporean consumer electronics chain Challenger, agrees that 2020 is shaping up as an uncertain year for business.

“Our last global recession happened many years ago and, based on past cycles, it looks like the next one will be coming very soon,” he says.

The impact of technological disruption will intensify pressure, according to Tan.

“This will result in a significant drain on companies’ resources and a significant reduction in their profitability. Businesses will not only have to be on the lookout for their traditional competitors, but they must also be aware of the threats from non-traditional potential competitors using advanced technology to grab a part of their business.”

The upshot? Tan expects job cuts across multinational and local corporations, forcing management to outsource services and production facilities to cheaper locations.

In India, multinational Wipro remains upbeat despite India’s GDP growth slipping to 5 per cent for the first quarter of the 2020 financial year, the lowest in six years.

Wipro provides IT, consulting and business process services to myriad sctors from from its headquarters in Bangalore.

Rajesh Udayamurthy CPA, who heads the Oracle sales, solutions and strategy for all regions except the Americas at Wipro, says India is “still performing far better than many other countries”.

He believes government tax incentives for business, robust foreign direct investment (FDI) policies and greater ease of doing business courtesy of digitisation and simplification of compliance mean the economy is well placed for steady growth.

For his fellow Indian CPA colleagues, Udayamurthy says an increasingly digitised economy means accountants will have to make the transition from being numbers people to becoming valued business consultants.

“There is a good future for CPAs here, as long as they are able to wear a consultant’s hat and use numbers for business transformation. That’s the future of accounting here and elsewhere.”

What's ahead for auditing?

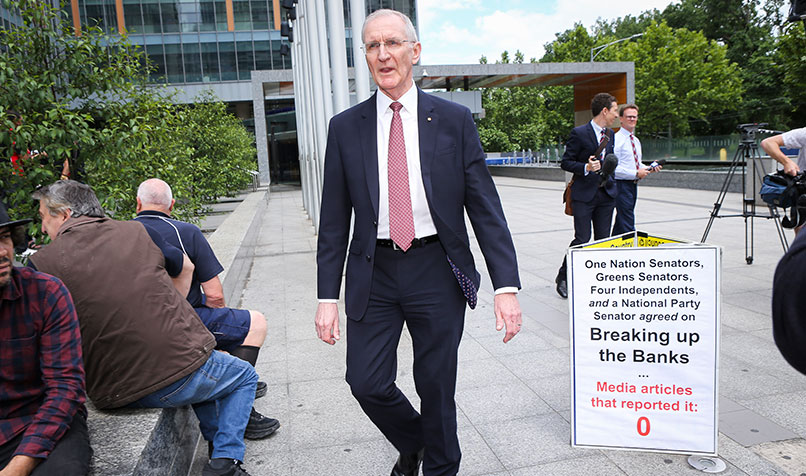

Auditing rarely appears on the front pages, but Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry and a general atmosphere of regulatory zeal across the region have clearly lifted the profile of this important discipline.

In Australia, Susan Drew, senior regional director of Hays Accountancy & Finance, says there has been a clear increase in internal auditing roles, especially in banking and financial services, “on the back of the royal commission”.

“Internal audit has always been an area that’s been quite candidate short because it’s quite a niche area, but we’re definitely seeing a spike,” she says.

Drew adds that while there will inevitably be some level of automation of the role in the future, there will still be a requirement for auditors who can provide “the human touch”.

"Internal audit has always been an area that's been quite candidate short because it's quite a niche area, but its definitely seeing a spike."

More broadly, Tan says accounting professionals must be able to think strategically, link and anticipate potential issues or problems, and eventually solve them.

“Unfortunately, such skills cannot be entirely taught in classrooms and through continuous training,” he says.

“It will have to be learned over time with experience and lessons learnt from past mistakes.”

Benjamin Jotkowitz, director of Benneaux Accounting Recruitment in Australia, says that as accounting professionals consider their career options in 2020, salaries will not be the only thing on their minds.

Cultural fit is increasingly important for job seekers, along with work–life balance allowances such as the ability to work flexibly from home as required.

“That’s what [the younger generations] are expecting as the norm, as opposed to always having to clock in and out,” Jotkowitz says.

He adds that it is incumbent on firms to keep up to date with technology trends. Tech-savvy candidates emerging from universities will baulk at firms using old platforms.

“If a business or firm has legacy systems, the candidates will say ‘thanks, but no thanks’.”

Investing in technology

According to the CPA Australia small business survey, Asian businesses are far more likely to be using technologies such as online sales, new payment technologies and social media than counterparts in Australia and New Zealand.

While digital disruption presents a threat to SF Holding, Ng says technology is also part of the solution.

With a view to increasing the predictability of operating and financial outcomes, her finance team assists the business development and marketing teams, integrating financial predictions and narrowing the analysis on trends and data to inform strategy on product and service delivery.

Weekly cost reports are also a critical element of planning.

“I don’t think we can do it all manually, because we have so many business units across China.”

Udayamurthy says in India there is pressure on all businesses to continue to innovate and automate to remain competitive. Most companies, he says, are investing in IT automation labs to bring together transformative enablers such as a digital workforce, cloud ERP, advanced security (particularly on data privacy) robotic process automation and cognitive automation.

Economic opportunities abound

In 2020, there is little doubt that the smart business leaders – in addition to investing in the strategic management skills of their enterprises – should be targeting opportunities in the fast-growing economies of Asia.

Tan says challenges for finance professionals will increase as CFOs are called on to anticipate and solve complex issues that have the potential to impact finances.

“[However], these challenges provide an opportunity for CFOs to demonstrate their ability to deal with multidimensional problems and become an important part of the senior management team.”

Ng says soft skills such as leadership credentials and the ability to communicate will be paramount. Most importantly, senior leaders must be able to pivot quickly.

“What may be your cash cow now could in a few months be killed off by a new business model that comes totally out of nowhere,” she says.

The high end of the market – that is, the express delivery of luxury items – has been a money-maker for SF Holding, but Ng knows things can change quickly.

Whereas finance teams once focused on what was profitable and what was not profitable, the emphasis now is on what competitors are doing and responding appropriately.

“For example, we may have to give more discounts to make sure we keep our market share. When there is digital disruption, usually these new services or products are free [at first] or very cheap.

"Sometimes you have to give up your [short-term] profits in order to be able to keep your competitors out.”

Accountants mean business on ESG

As expectations rise for businesses to become more sustainable through an environmental, social and governance (ESG) lens, accountants will be in the spotlight.

How? Through corporate reporting that helps companies integrate non-financial and financial information; and through auditing that informs stakeholders and helps businesses achieve their sustainability objectives.

Dr John Purcell FCPA, CPA Australia’s former ESG policy adviser, says there will be debate about how auditors and accountants contribute to corporate and economic transformation in relation to the challenges of climate change and associated issues such as biodiversity loss and the degradation of ecosystems.

“There needs to be a clearer understanding from accountants of the complex interconnection between environmental challenges and opportunities, and economic activity,” he says.

Purcell envisages accountants playing a key role in understanding such opportunities, for example, how financial numbers can inform ESG decision-making.

Yet accountants will have to go beyond mere figures, and ascertain what those financial numbers mean in terms of the prospects and opportunities for an organisation, and at the same time grapple with a proliferation of non-financial ESG-type disclosures. In this sense, their soft skills will be tested.

Accountants should relish the challenge.

“It’s an opportunity to engage,” Purcell says. “Never before has the profession been in a better position to understand some of the global trends that are taking place.”

What is clear is that in the future, ESG reporting must become part of a healthy business environment, rather than a burden.

This includes responses to the Modern Slavery Act, which requires entities to make annual reports on their actions to address slavery risks in their operations and supply chains.

Purcell says, as a consequence, accounting practices will require a deeper understanding, analysis and focus on supply chains, including elements such as blockchain.

Improved transparency will also come to the fore as corporate governance goes well beyond shining a light on internal behaviours only, Purcell observes.

“It opens organisations up and gives them an opportunity, the wherewithal and the tools to analyse their practices… not so much to be able to detect instances of poor practice and wrongdoing, but to actually build resilience, which prevents the incidents from happening in the first place.”

Regulatory frameworks in the spotlight

Expect the regulatory environment to again be in the headlines in 2020 across the Asia-Pacific region.

A parliamentary joint committee inquiry into the regulation of auditing in Australia has been established, with a report set to be issued in March 2020. The inquiry will consider, among other issues, the relationship between auditing and consulting services and potential conflicts of interest.

The move comes as CPA Australia also issues a call for a review of the current financial advice frameworks to address regulatory complexity, with late general manager external affairs Paul Drum FCPA commenting that “the wholesale review must identify policy changes needed to ensure that consumers can access quality, affordable advice from their choice of trusted adviser”.

Regulatory frameworks are in the spotlight in China, too. The Chinese Government is making changes to the business environment – for domestic and foreign firms alike – that are expected to vastly increase the amount of data companies must share with authorities.

The idea is to collate information from businesses and integrate it into a centralised digital database, according to the European Union Chamber of Commerce in China. The move has been likened to a social credit system under which regulators could rate companies according to compliance with regulations, and put them on blacklists if they do not adhere to the rules.

Ng says there is no doubt such digitally driven reforms could put additional pressure on finance teams, which could be subject to a “red flag” if they get reports wrong or do not comply with regulations.

“If you do not have a good system to capture that red flag, then there will be real compliance issues.”

In Singapore, Tan says complexity around finance and accounting-related rules has stabilised. The regulators are zeroing in on issues such as sustainability, carbon footprint and personal data protection.

He adds that the buck will stop with CFOs in terms of compliance.

“[They] will inevitably be expected to have oversight and ensure adherence. This will add to the existing demands of a CFO.”

State of the job market

There is good news for accounting and finance professionals seeking permanent work in Australia.

Recruitment agency Hays reports that the permanent recruitment market has been “busier and more buoyant” since the start of the financial year, and notably after the end of the federal election in May. Permanent roles have increased by about 25 per cent compared with 2018.

“People were probably holding ground in the lead up to the election, and they now have more confidence,” Susan Drew says.

Benjamin Jotkowitz comments that the Big Four accounting firms are “doing it tough” in terms of retaining staff and recruiting new talent.

“The feeling we get is that most candidates want to move out into industry… if they’ve got no desire to move into a partnership level,” he says.

More than ever, Jotkowitz says accountants want to be in client-facing advisory roles “doing analysis, forecasting and budgeting”.

According to the FY2019/20 Hays Salary Guide, senior finance salaries in Australia are not rising above CPI, the exception being in-demand analysts, management accountants and commercial managers who can analyse a vast array of data.

Drew says the greatest potential for salary hikes comes in the form of counter offers for candidates looking externally “because [firms] don’t want to lose talent”.

The 2019 Hays Asia Salary Guide reports that in China, the consumer goods industry – including fast-moving consumer goods (FMCG), retail and luxury – is undergoing a digital transformation, which is creating demand for talent around digital and e-commerce finance.

In Hong Kong, compliance work is strong, while the emergence of artificial intelligence, cloud technology and blockchain has led to demand for candidates with different skill sets to the norm within the accountancy and finance and risk and compliance fields.

In Singapore, accountants and finance managers are being sought to ensure corporate governance and compliance standards are met.