Loading component...

At a glance

Job opportunities

An upswing in regional and global growth, the ever-growing volumes of data employed in business practices and an increasing uptake of international financial reporting standards are all expected to keep accountants in high demand in the Asia-Pacific region in 2018.

In its World Economic Outlook 2017, the International Monetary Fund expects China and other emerging Asian economies to expand by a healthy 6.5 per cent this year – in some instances even more.

These are exciting times for those in the region whose job it is to help corporations keep a handle on their financial performance, advise on strategy, and enable businesses to make best use of the vast mountains of data they are accumulating.

It’s not only big companies that are on a growth path.

In 2016, CPA Australia’s Asia-Pacific Small Business Survey found that small businesses in Indonesia, Vietnam, mainland China, Hong Kong, Malaysia and New Zealand were all upbeat about their growth prospects, particularly those that are focused on innovation, e-commerce, social media and export.

Ivan Au FCPA, president of CPA Australia’s Greater China Division and assurance partner for PwC China/Hong Kong, keeps a close tab on developments in Hong Kong and mainland China, and is buoyant about the outlook for the profession.

He says now is a great time for CPAs on the hunt for new opportunities, because of the growing recognition of the wide range of valuable skills the CPA qualification embodies.

“Twenty years ago, people would think about CPAs as being good in accounting and finance, but would not think too much beyond that,” he says.

“Now, people recognise that CPAs have advanced analytical skills, which make them suitable for a wide range of management and operational roles.”

To get a sense of the scale of growth and activity underway, consider that in 2016 Hong Kong overtook the US to become the world’s largest market for outbound merger and acquisition (M&A) activity.

While companies from mainland China are seeking to increase their global footprint, multinationals from the West are buying into Asian and Hong Kong companies to deepen their penetration in the region.

China’s massive One Belt, One Road initiative is another big spur to regional growth.

The ambitious government program is pouring about US$150 billion a year into infrastructure projects in 68 countries throughout eastern and central Asia, according to The Economist.

This is generating a lot of demand for accountants, says Au.

In addition to helping boost M&A activity in Hong Kong, the initiative has meant mainland Chinese corporations need even more accountants as they seek to undertake and manage operations in a variety of countries and jurisdictions.

The talent crunch

Important as China is in the Asia-Pacific, it is only part of the story. Christopher Wong FCPA, head of assurance at EY in Singapore, expects the strong call for accounting skills experienced in Singapore and other countries in the region last year to continue through 2018.

“Demand for accountants continues to be strong in Singapore, as our economy is on a rapid transformation in many sectors, with businesses being e-enabled, scaled up and disrupted,” Wong says. “Further, our neighbouring countries in ASEAN [the Association of Southeast Asian Nations] are among the fastest growing in the world, which helps drive up demand for accountants.”

This is borne out by the experience of Kuala Lumpur-based Pauline Ho FCPA, assurance partner at PwC Malaysia, who says accountants are in high demand in emerging economies in the region, such as Malaysia and Vietnam.

“The war for talent is very real, and I hear the same comment regardless of where I travel to within South-East Asia,” she says. “The talent crunch has been a constant challenge for this region, especially with the outflow of experienced professionals to mature markets like Australia and the UK.”

While the majority of employers try to recruit accountants from their home market, stiff competition is forcing some to cast a wider net. Some businesses are taking part in careers fairs in places such as Australia and the UK, Ho says, and PwC Malaysia runs its own Aspiring Accountants Programme to hire and train graduates from disciplines outside of accounting and finance.

Employers such as PwC are looking for graduates with a balance of strong technical skills, including IT skills, along with good communication and relationship management skills, says Ho. She adds that it’s also important to develop good management abilities, given that experienced accountants are required to lead teams and engage with clients.

Even graduates who come equipped with wide technical, communication and analytical skills often fall short of what is required.

“It’s great that we are able to widen the pool of talent, but one of the areas of improvement [needed] for both Malaysians and the Vietnamese is in their English proficiency.

“I’d also like to see graduates with a broader world view beyond their coursework. Business and global acumen are key attributes for them to succeed in the workplace,” she says.

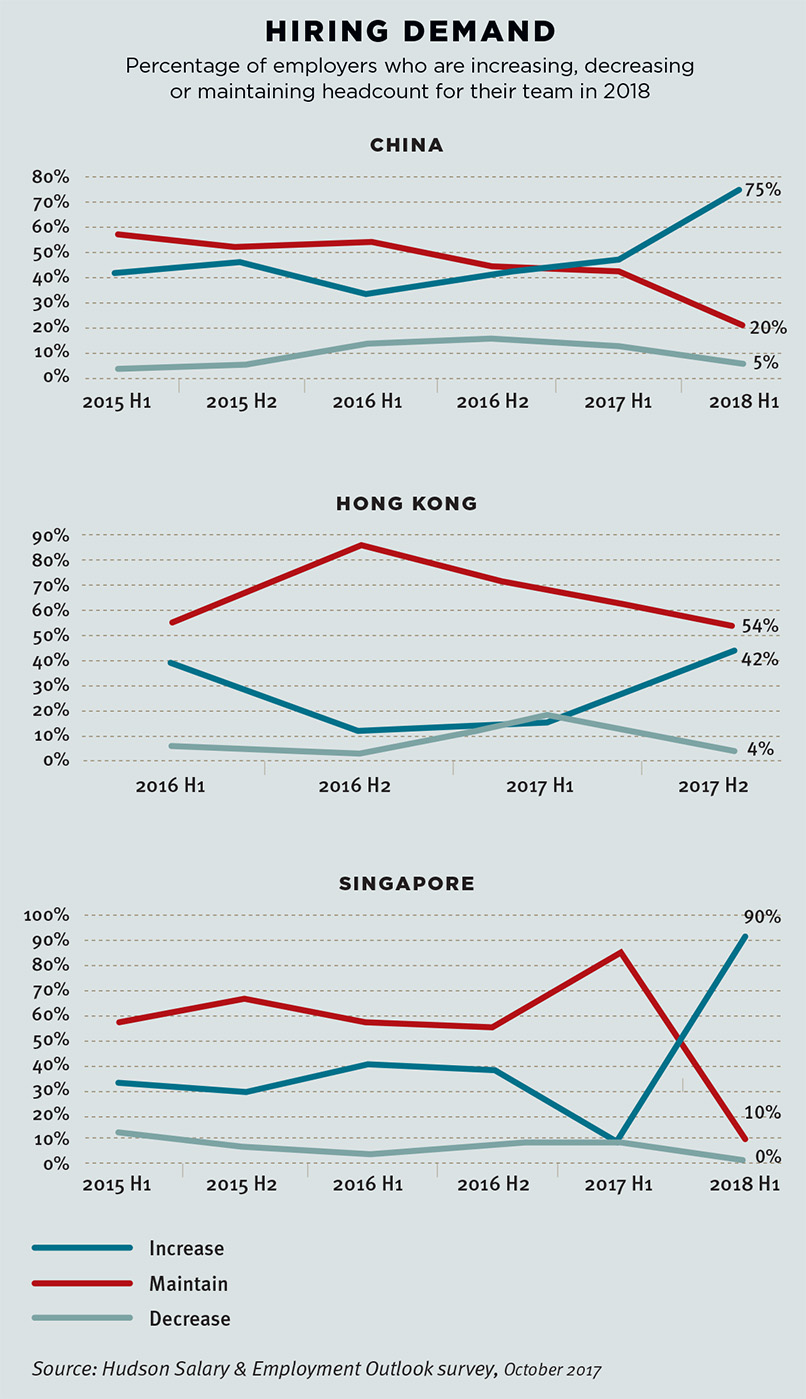

The strength of the regional job market for accountants has been highlighted by research from recruiting company Hudson.

A survey of 4122 employers in October 2017 found that 90 per cent of those in Singapore, 75 per cent of those in mainland China and 42 per cent in Hong Kong planned to recruit more accountants in the first half of 2018. Most of the rest of those surveyed for the Hudson Salary & Employment Outlook intended to at least maintain their accounting and finance headcount.

More data drives demand for more CPAs

Even though an increasing number of tasks in auditing and transactional accounting are being automated, this is merely changing what accountants do, as opposed to making them redundant, says Linda Hudson, manager of the accounting, finance and legal practice at Hudson recruitment in Brisbane.

“Rather than putting accounting professionals at risk, automation is transforming the industry in positive ways, and creating greater demand for candidates with analytical skills to provide deeper business insights,” she says.

It is in the management and analysis of data where some of the most promising and exciting opportunities for CPAs may lie, according to Au and Ho.

The continuing development of digital commerce, social media and the internet of things mean that, more than ever before, companies have access to mountains of data about customers, competitors, markets and their own operations.

The challenge is how to make best use of the vast troves of data, and this is where CPAs with good analytical and technological skills are shining.

“Many corporations are sitting on a lot of data, and they are confronting the question of how to make the best use of it,” Au says.

“With their background in accounting and financial management, CPAs have the skills to organise and analyse large amounts of data and apply the insights they gain to operational and management roles.

“That is one of the big drivers of the growth in demand for CPAs in this region.”

Ho sees a similar trend in Malaysia and Vietnam.

“The ability to embrace technology in their work is key,” she says. “As with many other areas, the ability to understand and leverage data analytics will become increasingly important.”

As Hudson puts it: “Transactional, processing-type work is out and analytical, business partnering, value-add is in at every level. Businesses want to employ candidates that display potential to interpret data, order and assess its value, and present the findings to the relevant stakeholders in a clear and concise way.”

Wong says the most highly sought skills are those that enable accountants to collaborate, support and partner other business functions within an organisation.

“These include soft skills like business acumen, leadership, communication and influencing, analysis and advisory, as well as technological skills such as information technology and digital skills, network and information security skills, and information management skills such as statistical analysis and data mining,” he says.

The skills hunt

Although the number of universities and other institutions running accounting programs is expanding, there is concern that students are not graduating with the skills they need to be successful.

Firms are responding to this by looking beyond finance graduates to find candidates with the skills they need.

“Employers today are open to hiring from beyond traditional sources,” Wong says. “Talent from the current generation choose varied educational paths [and] employers are prepared to explore non-traditional sources to find [them].”

Firms are particularly keen on accountants with the right combination of technical and soft skills to be effective business partners, says Hudson.

"Transactional, processing- type work is out and analytical, business partnering, value-add is in at every level."

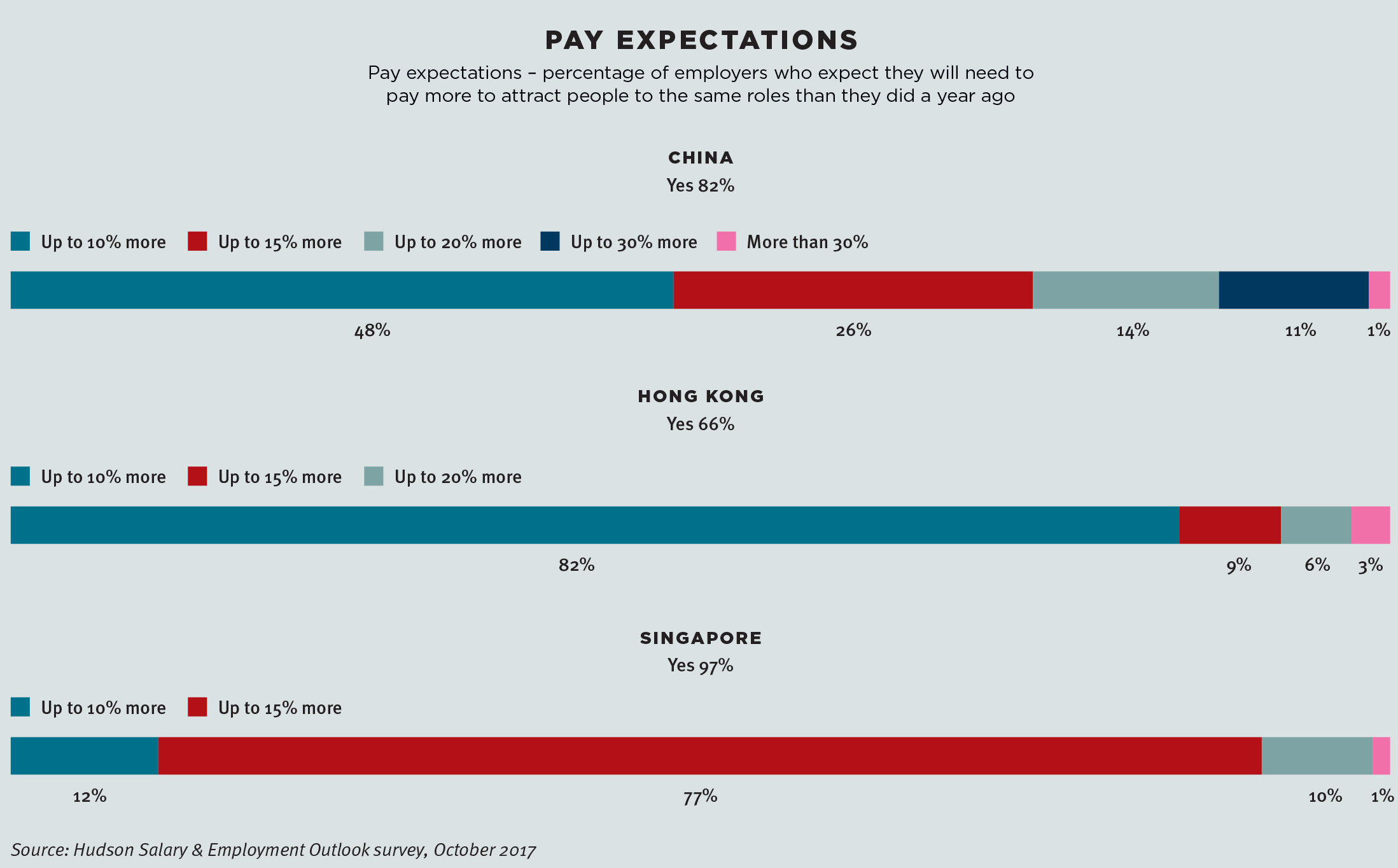

“Particularly in Asia, there is a demand/supply imbalance, with a shortage of top candidates who can be true business partners. These candidates are in high demand and are attracting higher salaries as a result,” she says.

The spread of digital technologies and the disruption to current business models that they will cause, the increasing globalisation of production, and changes in regulation and governance are expected to significantly transform what accountants do.

To meet these challenges, finance and accounting professionals think they will need to be equipped with the ability to think strategically, have business acumen, and to possess skills in leadership, communication, data mining and statistical analysis.

“The evolving role of the accounting professional calls for new skill sets, and it is clear that they need more than technical skills if they are to remain relevant in organisations,” says Vincent Toong FCPA, assurance partner at EY in Singapore.

“As accounting professionals are increasingly being asked to be business advisers to other functions in their organisations, it is not surprising that strategic thinking, business acumen and leadership skills rank high. Further, as more companies recognise the value of data and analytics, these professionals need to be able to harness technology to extract insights so that they can support better decision-making.”

New accounting standards

Keeping up with IFRS changes

Even as accountants grapple with the changes being wrought by information technology and globalisation, they are also being called on to help businesses understand and implement a number of far-reaching reforms to international financial reporting standards (IFRS).

Two of these reforms, one that will have a significant impact on banks – including how they make provisions for loans – and the other on how revenue from customer contracts is reported, came into effect in January 2018.

IFRS 9 Financial Instruments, includes radical new loan provisioning requirements and was developed following the global financial crisis, when banks failed to make provisions for poorly performing loans until too late.

Under IFRS 9, instead of reporting an incurred loss, lenders are now required to look ahead and make provision for any expected loss on loans.

This change is expected to reduce the profitability of banks, but Ram Subramanian, CPA Australia policy adviser – reporting, policy and corporate affairs, warns that it is not only banks that are affected by the change. Companies with financial instruments such as trade recoverables will also need to make provisions for expected, as opposed to incurred losses, he says.

More changes came into effect at the start of January, with the introduction of IFRS 15 Revenue from Contracts with Customers affecting how revenue from contracts with customers is reported.

The new standard replaces and consolidates several existing standards and interpretations including IAS 18 Revenue, IAS 11 Construction Contracts, IFRIC 13 Customer Loyalty Programmes and IFRIC 15 Agreements for the Construction of Real Estate.

“Many see this as a good move because they have consolidated a lot of different standards with revenue requirements into one, and made it more robust and principled,” Subramanian says.

He warns, however, that the effect of the standard will be felt quite broadly, including by businesses in real estate, telecommunications, retail, shipping and the airline industry.

Another positive from the introduction of IFRS 15 has been to smooth the way for Malaysia to fully adopt the IFRS framework.

Subramanian says that before the introduction of IFRS 15, Malaysia had held short of fully embracing the IFRS system because “it did not do everything that they wanted it to do”. But with the advent of the new standard, those lingering concerns have gone.

Preparing for IFRS 16

Subramanian cautions that the challenges and disruption caused by these IFRS is set to increase with IFRS 16, a new standard due to come into force from January 2019.

IFRS 16 Leases, which has been under development for years and supersedes International Accounting Standard 17, will have far-reaching implications for businesses in the way they use and account for leases.

Under the new standard, the distinction between finance and operating leases is dropped. Instead of operating leases being expensed over the lease term, all leases must be reported as an asset and a liability on the company balance sheet.

In a paper published in the journal Property Management in 2016, Clive Warren, from UQ Business School, says this is a substantial change and “may result in many organisations moving toward owner occupation over leasing, as the financial accounting advantages of leases will no longer apply”.

"[IFRS 15 has] consolidated a lot of different standards with revenue requirements into one, and made it more robust …"

Property managers are among those who might be hit hardest.

“The changes seem likely to impact retail lessees the most, as the use of operating leases is far more prevalent in the retail sector,” Warren says, adding that bringing leases onto the balance sheet is likely to affect key company financial ratios.

Ideally, Subramanian says, the changes brought in by IFRS 16 should not alter the way companies conduct their business, but Warren thinks this is a possibility.

“Whether, over time, this will have a roll-on effect to the behaviour of organisations when making the lease/buy decision remains to be seen,” he says.

Subramanian says that implementing IFRS 16 will be challenging, including calculating the lease assets and liabilities on an ongoing basis.

There will also be definitional challenges, he says. For example, renting a car space may be a lease if it is in a specified spot, but may count as a service if it merely connotes a claim on an unspecified parking spot.

Bringing in IFRS across the region

Although 126 countries have adopted IFRS, the framework is far from universally applied in the Asia-Pacific.

In the region, 16 jurisdictions have either fully adopted the IFRS system or, as in Hong Kong, have made local standards virtually identical with IFRS.

On its website, the International Accounting Standards Board (IASB) states that China has committed to adopting IFRS and has substantially merged its local standards with those of the international system.

A CPA Australia-funded survey of senior financial executives in Chinese listed companies found that, in general terms, Chinese Accounting Standards have converged with IFRS, with a few exceptions, such as the Chinese preference for historical cost accounting rather than fair value accounting.

“Many organisations in Malaysia are still in the process of evaluating the impact [of these standards] to their financial position and results."

The study, published as “Insights from accounting practitioners on China’s convergence with IFRS” in June 2017 in the Australian Accounting Review, also found the extent to which Chinese firms adopted IFRS was influenced by the level of expertise of their accountants and the ownership structure of the firms involved.

Japan is yet to formally adopt IFRS, however a process of convergence with Japan’s own Generally Accepted Accounting Principles (J-GAAP) is underway.

The results of a survey of 292 senior financial executives of Japanese listed companies (published in May 2017 Australian Accounting Review as “Transitioning to IFRS in Japan”), found general acceptance that adopting IFRS would provide corporations with a “moderate degree of benefit”.

However, the survey also identified concerns in Japan regarding the adoption and implementation of IFRS, including uncertainty about the interpretation of standards, challenges of staff training, the adjustment of IT systems, technical knowledge and differences with J-GAAP.

Au says firms in Hong Kong and China are adapting to and implementing the latest standards.

“A lot of companies are looking into these changes in terms of their impact on their systems and financials,” he says. “Some of these changes are imminent and a lot of work is being done by both corporations and accounting firms in quantifying the impact and evaluating what systems and processes need to change.”

In Malaysia, local financial reporting standards have been made “substantively equivalent” to the IFRS. Nonetheless, the implementation of the three new standards is far from uniform, says Ho.

"Now, people recognise that CPAs have advanced analytical skills, which make them suitable for a wide range of management and operational roles."

“Many organisations in Malaysia are still in the process of evaluating the impact to their financial position and results,” she says. “I would encourage those companies that have not considered these standards in detail to spend some time to assess their impact, as all three are complex.”

The changes to contract revenue accounting in IFRS 15 are particularly significant for the information and communications technology and real estate industries, says Au, while IFRS 16’s changes to the treatment of leases has the greatest implications for property management companies and retailers.

The effects will be most challenging for companies with multinational operations, because of differences between countries in the underlying terms and conditions that apply.

However, Au says there is no sign of resistance among firms to adopting and implementing the new standards, not least because of the exhaustive consultation process undertaken in their development.

“These standards have been discussed for a very long time. There has been a lot of debate and discussion before they were introduced, and companies have been given a long time to adapt to them before the effective date, so it has given them a lengthy time to evaluate and adapt,” he says.

More change ahead

Even with the major revisions to accounting practices contained in IFRS 9, 15 and 16, the IASB is not done yet.

IFRS 17 Insurance Contracts is not due for implementation until January 2021, but can be applied earlier by those already using IFRS 9 and IFRS 15.

The new standard includes provisions to combine the current measurement of the future cash flows with recognition of profit over the period that services are provided under an insurance contract. It separates insurance service results from finance income and expenses, and requires organisations to choose whether to recognise all insurance finance income or expenses in profit or loss, or to include some of that in other comprehensive income.

Subramanian says that although the new standard will primarily affect the insurance industry, it will also have implications for businesses that have “insurance products in their mix”.

The introduction of sweeping new accounting standards, combined with a solid growth outlook, bode well for accountants in the Asia-Pacific in the year ahead. However, strong demand does not guarantee an armchair ride into a top-paying job. For that, finance professionals will have to think beyond accounting and develop their strategic thinking and technology skills.

The view from Port Moresby

In 1989, when James Kruse FCPA landed in Port Moresby, the capital of Papua New Guinea (PNG), he was a young accountant from Brisbane looking for travel and adventure.

Little did he know that an 18-month secondment in KPMG’s audit division would turn into a 28-year love affair with the small Pacific nation.

Now a partner with Deloitte and president of CPA Australia (PNG Branch), Kruse says the variety of work and opportunities on hand in the country are “immense”.

“During my career I have worked not only in public practice but in a commercial accounting role for an exploration and mining company, on an agricultural commodity board, and an importer and wholesaling company with its origins in PNG going back almost 100 years,” he says.

The resource-rich country is one of the most linguistically and ethnically diverse in the world – more than 800 languages are spoken – and in many respects it is still in the early stages of economic development.

It can make for volatile conditions. Wild gyrations in global commodity prices in recent years have seen PNG’s economy take a rollercoaster ride.

Asian Development Bank data shows growth soared above 13 per cent in 2014, slumped to 2 per cent in 2016 before clawing up to 2.7 per cent in 2017.

Kruse says it makes for a dynamic environment. “PNG is a fantastic place to be working as an accountant. No one day is ever the same, and there are always challenges and new issues arising where CPAs are called upon to assist and advise [clients].”

No longer are CPAs only concerned with meeting reporting and compliance deadlines. “Today’s CPAs need to keep up to date with economic and legislative developments; to respond and deliver solutions and advice to help their employers or clients make the most of the opportunities,” Kruse says.

For the past 15 years, as a Deloitte partner, Kruse has been called on to provide tax and accounting solutions for businesses in hospitality, resources and mining, trade and manufacturing, transport and agriculture.

He also provides financial and restructuring services, including insolvency, valuations, business sales, and mergers and acquisitions.

His portfolio of work reflects the expanding role being played by CPAs across the Asia-Pacific region.

“CPAs are increasingly looked upon as trusted advisers and key members of the leadership team; people who can deliver insight and solutions and value-add,” he says.

It is a job description that requires not only technical competency but also a broad and flexible outlook.

“Employers and businesses are looking for CPAs with a can-do attitude, a willingness to adapt to different roles, and to manage multiple and sometimes competing priorities.

“Ongoing technical training, being aware of domestic economic conditions and a willingness to commit to getting the job done are essential.”

It definitely sounds like a challenge, but for those willing to give it a go, Kruse says rich opportunities await.

Setting the standard

IFRS 9 – Financial Instruments

Under IFRS 9, loans are classified into one of three categories:

Stage 1. When a loan is made, lenders are required to make a provision equivalent to the expected loss on it over the coming financial year.

Stage 2. If the credit risk of the loan increases, the lender must increase its provision to match the expected loss over the life of the loan.

Stage 3. If the loan goes bad, the provision made at Stage 2 is maintained but the lender must allow for reduced interest revenue in proportion to the expected loss on the loan.

IFRS 15 – Revenue from Contracts with Customers

IFRS 15 sets out the principles to be applied in reporting customer contract revenue, including their nature, amount, timing, revenue uncertainty and cash flows.

It incorporates a five-step model to guide the application of the new accounting standard.

The model details:

- The criteria to apply in identifying a contract with a customer.

- How to define the performance obligations of the contract.

- How to determine the transaction price (including where the amount may be variable).

- How to allocate the transaction price to the performance obligations of the contracts.

- When to recognise revenue.

IFRS 16 – Leases

IFRS 16 supersedes IAS 17 and requires more extensive measurement and recognition requirements for leasing activities to enable assessments of the amount, timing and uncertainty of cash flows from leases. In essence, for a lease to exist, a contract must:

- have an identified asset

- provide for the customer to obtain substantially all the economic benefits from the use of the identified asset; and

- allow for the customer to direct the use of the identified asset

Under IFRS 16, leases should appear on the lessee’s balance sheet and recognise:

- a right-of-use of the asset

- a lease liability

Initially, the lease liability is to be measured as the present value of future lease payments. The value of the right-of-use asset is based on the lease liability, adjusted for any prepayments, lease incentives and initial direct costs.

Exceptions are made for leases that are for 12 months or less, or for low-value assets of less than US$5000.