Loading component...

At a glance

As clients face a myriad of challenges to remain in business and prepare financial statements given the impact of COVID-19, auditors also have practical difficulties, ranging from accessing client information to additional time needed to assess the impact of COVID-19 on asset impairments, uncertainties related to going concern and subsequent events disclosures.

The UK Financial Reporting Council (FRC) has acknowledged that travel restrictions and social distancing obligations have resulted in the interruption of regular business operations, client engagements and access to client sites.

The ability of entities to obtain data essential to the preparation of financial statements is considerably affected, particularly for those with significant operations in countries severely affected by COVID-19. This will result in delays in receiving financial data from subsidiaries or components for group audits and will be further exacerbated as more and more audit firm employees shift to working remotely. In some countries, secondments from other jurisdictions – relied on by audit firms to meet demand in busy periods – have been curtailed.

In such testing times, auditors are looking to develop and leverage alternative procedures to audit clients’ financial statements. By harnessing available technology, they may be able to better fulfil their audit obligations, mandatory isolation notwithstanding.

As reported by the World Economic Forum (WEF), technology powered by artificial intelligence (AI) is helping track the COVID-19 outbreak, clean hospitals, deliver supplies and support the development of vaccines. AI, as well as other technologies, can also help the accounting profession master the challenges posed by COVID-19.

Auditors are already using various information and communication technologies (ICTs) – spreadsheets for checking samples, macros for running analyses and emails to engage with clients. However, these only allow them to work remotely to a limited extent. To fully transition to remote work, existing ICTs need to be enhanced with additional technological solutions that facilitate remote communication within the audit team, information gathering, reconciliation of transactions, and financial analysis and interpretation.

A range of technologies are available that can enable audit team members to collaborate effectively in real time, even when working remotely in different locations. Some are used by technology providers) to help auditors substitute in person or on-site fieldwork and enable continuity in meeting their reporting obligations. For further information, see the breakout box.

The crux of the issue is how can technology assist auditors to continue their work remotely during COVID-19 restrictions?

Excel-based tools can increase efficiency

Paul Winter, partner CFO Advisory at KPMG Australia, says KPMG’s Financials Checker tool was a result of identified “pain points” for auditors that needed to be alleviated, noting that “not only can the manual checking of financial statements be time-consuming, but also audit quality is at risk of being compromised, as recently discussed in the Parliamentary Joint Committee Inquiry into Audit Regulation in Australia”.

“Financials Checker allows auditors to allocate more time to focus on audit quality by taking away the need for manually checking financial statements,” Winter says. “Because of COVID-19, there is going to be much concern around companies’ capability of continuing as going concerns and the assessment of that.”

“We want our auditors to focus on these going concern assessments and not worry about potential rounding errors in the financial statements, performing add checks and identifying instances where notes don’t tie to the primary financial statements. Financials Checker automates the internal checking of financial statements. While manual financial statement checks can take in excess of five hours per draft, Financials Checker can do the job in under 30 minutes.”

Notably, Excel add-ins such as these are easily installed and require minimal training to apply.

Audits can be done remotely with the right technology

In the face of COVID-19, Inflo chief customer officer, Olwyn Connolly and her team are addressing a critical business challenge: how can accounting firms remain productive and continue to deliver important audit, tax, and advisory services when their employees are not in the office?

Inflo is a cloud-based platform which auditing firms can use to extract financial data from client accounting systems and analyse the data by applying a range of emerging technologies.

“As our customers settle into the new remote working norm, we’re not surprised to hear about the great technologies they have deployed to keep their staff connected and internal operations online,” Connolly says.

“But it remains surprising how many firms still don’t have a secure, structured method of collaborating with their clients to perform services remotely.”

With no clients working on-site in many territories, secure, real time file sharing across engagement and client teams has become vital. The Inflo platform provides a secure portal for the engagement team to access information from clients in a streamlined way to remain productive.

“The enhanced transparency and accountability that our functionality delivers are important to ensuring clients can see workflow and progress when the engagement team is not physically on-site,” Connolly adds.

On the Inflo platform, engagement teams can share results and request further information from the client efficiently and securely.

“Technology has been advancing audit testing and procedures for a while now, and that’s not going to change no matter what’s happening in the profession,” she says. “But now, more than ever, enhancing the relationship with and the value you add to your client is critical, and that is where we are focusing our conversations and support.”

Importantly, Inflo can be set up and implemented within hours.

Remote working will fast track new technology implementation

“Point in time audit will not be part of the new world,” argues MindBridge Ai Auditor senior vice president, sales, John Colthart.

“What is important is to put auditors into the driver seat again to allow them to answer questions such as how the business is performing and the financial risks it currently faces. Especially [during this] time of COVID-19, having access to real time data is crucial for auditors to perform going concern assessments.”

MindBridge Ai Auditor enables assessment of 100 per cent of clients’ transaction data, and for auditors to analyse and visualise patterns of historical transactions. In simple terms, clients can post their data to the cloud, which auditors can then access.

Colthart emphasises that while Ai Auditor highlights transactions that appear to be “odd”, it is not a fraud detection tool.

“Our intention is to support our clients to provide a higher degree of assurance through full population testing,” he explains. “It becomes important to review all data. It is continuous checking that is essential.”

MindBridge director of sales Australia and New Zealand, Shaye Thyer, adds that auditors have even greater responsibilities in the current environment. “If auditors can use technology for routine tasks, then [during] these unprecedented times they can focus on high-level analysis and data interpretation,” Thyer says.

“We need to be in a very cloud-friendly environment so that auditors can access the data from everywhere. That becomes more essential when people are forced to work remotely.”

New users can learn online about how to use Ai Auditor and implement it within a few hours. It can also cater to a range of different size audit firms.

Inflo, KPMG, and MindBridge agree that those who take action now and leverage opportunities provided by technology will not only manage to mitigate risks but also remain more resilient to future challenges.

To this, Roy Lo FCPA, managing partner at Shinewing Hong Kong, adds in a recent CPA Australia case study that “it is imperative for businesses to move with the market and continue to invest in technology regardless of the current business environment”.

It is also worthwhile noting that technology service providers are looking at ways to assist firms of all sizes with flexible arrangements and in some cases offer free product trials.

Assessing the best service for your business

Founder of Practice Connections Alan FitzGerald, an independent adviser who assists accounting firms choose software best suited to their firm’s goals, has observed that “over the past few years, it has been too easy to throw software at a problem, rather than understand what the actual problem is and if existing solutions from within the firm could be used”.

Indeed, it is not uncommon for audit firms to invest in software they either do not fully understand or do not require for the services they provide.

“Some firms don’t even know what they are paying for, so the key to success is to identify the technology service or software that caters to a firm’s individual needs,” FitzGerald says.

Inappropriate software leads to unnecessary expenses, so “now is the time to have your technology stack reviewed and do some ROI calculations”, he advises.

Dr Jana Schmitz is Policy and Research Analyst at CPA Australia

Key tech facts you need to know

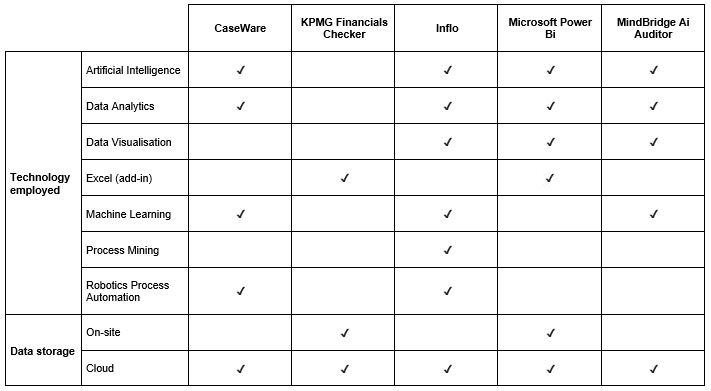

CaseWare allows for and supports cloud accounting, data import, data mapping, data validation, AI-based testing, AI-based analysis, automated preparation of financial statements, data visualisation and compliance.

Financials Checker automates the internal checking of financial statements, annotating the primary financial statements to the notes in under 30 minutes, which manually, can take up to a day in some instances. Financials Checker is not limited to financial statements and can be used on any report that contains numbers within tables and internal referencing.

Inflo combines digital client collaboration, a suite of advanced analytics and the direct extraction of data from 100 per cent of client accounting systems.

Microsoft Power BI is an enhanced Excel capability with hundreds of data visualisations, built-in AI capabilities, tight Excel integration, and prebuilt and custom data connectors.

MindBridge Ai Auditor is an AI-powered risk assessment platform able to analyse 100 per cent of transactions. Ai Auditor identifies unusual transactions by looking at transaction flows between all accounts and evaluates them against AI and machine learning-based controls.

CPA Australia provides these as examples only, but does not endorse any particular providers or software.

Sources:

- AASB/AUASB (2020), The Impact of Coronavirus on Financial Reporting and the Auditor’s Considerations

- UK FRC (2020), Guidance on audit issues arising from the COVID-10 (Coronavirus) pandemic

- UK FRC (2020), The Use of Technology in the Audit of Financial Statements, AQR Thematic Review, March 2020

- World Economic Forum (2020), Here’s how Asia is using tech to tackle COVID-19