Loading component...

At a glance

- Australia is deeply involved with the battery supply chain, but only at the resources stage.

- Once minerals are delivered, China controls the vast majority of global battery production.

- There are significant opportunities for Australia in the refining of minerals.

Perhaps the most vital of battery ingredients, and currently at the heart of the broader battery economy, is lithium. It is a soft, white mineral extracted from the ground or from saline groundwater known as brine.

Also referred to as “white gold”, lithium is one of several minerals that make up the mix that drives electric vehicles (EVs) and enables smartphones, power tools, laptops and much, much more.

Thanks to the battery trade, the value of lithium is counted in more than dollars and stretches well beyond chemistry.

Lithium holds an enviable place at the intersection of technology and trade, mining and manufacturing, the global economy and the clean energy transition.

“Batteries begin with mining,” says Jairo Bernal CPA, former head of finance and company secretary at Chilean lithium-mining company SQM. “When it comes to EV batteries, you are looking at a critical mix of lithium, cobalt, nickel, graphite and manganese — and let’s not forget copper, essential for conductivity.”

These critical elements are sourced from different geological settings around the globe. Lithium, for instance, is mainly extracted from hard rock deposits in Australia, or from brine found in the salt flats of Chile and Argentina.

"At present, there is an oversupply of about 200,000 to 300,000 tonnes of lithium carbonate equivalent. We are likely to see this imbalance persist for another two to three years. In this environment, success will come down to resilience and whether producers can remain profitable at today’s lower price levels."

Cobalt is predominantly mined in the Democratic Republic of Congo (DRC), while nickel is largely produced in Indonesia and graphite is sourced mainly from China, Brazil and Mozambique. And this explains the complexity and global nature of the battery supply chain.

Mining companies can sell their raw materials through several channels. They can do so directly to battery manufacturers such as CATL, LG Energy Solution, Panasonic or Samsung; or to automakers like Tesla, BYD, General Motors and BMW via direct or long-term contracts.

Alternatively, large commodity traders including Glencore, Trafigura, Sumitomo and Hanwha purchase materials from miners and distribute them.

The majority of battery producers are headquartered in China, also home to approximately 75 per cent of the world’s lithium refineries that process raw lithium into lithium hydroxide or lithium carbonate.

“The raw material we produce in Australia and sell on is known as a spodumene concentrate,” Bernal says. “It has a greyish-white, sand-like appearance and it is produced after the ore is crushed. In a processing plant, it undergoes flotation to separate the lithium-bearing minerals.”

“In the Chinese refineries, the lithium is refined into what looks like crystals or like small rice grains. There is great opportunity to build refineries in Australia, too.”

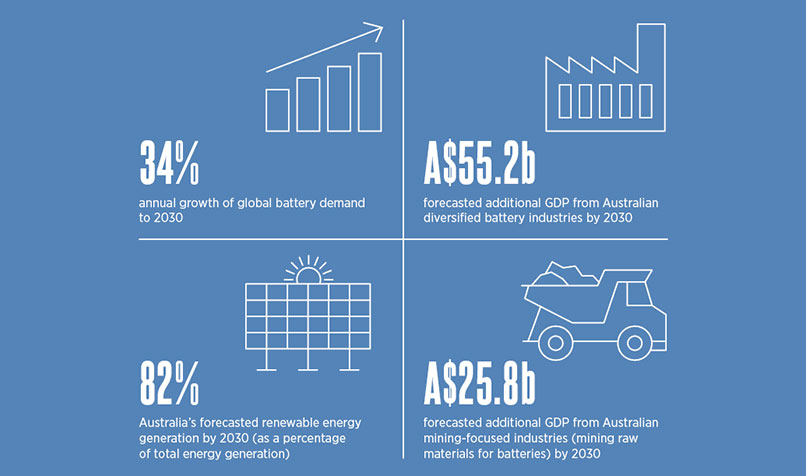

A 2023 report from Accenture and the Future Battery Industries CRC, titled Charging Ahead: Australia’s battery-powered future, supports Bernal’s point of view. “Australia’s breadth of critical mineral reserves creates the opportunity for domestic lithium refining costs to be reduced by 37 per cent by vertically integrating mine production with lithium refining,” the report notes.

“Australia now has the opportunity to build thriving domestic battery industries that will provide A$16.9 billion in gross value added and support 61,400 jobs by 2030," notes Bernal.

Not all batteries are created equal

Battery composition is tied to cost, performance and market segment. In the field of EV batteries, there are three main combinations.

- LFP (lithium, iron, phosphate): “This is the most popular EV battery chemistry, used in about 55–60 per cent of the market, largely produced in China,” Bernal says. “It’s more cost-effective because it doesn’t contain cobalt or nickel. It offers solid safety, a long cycle-life [the number of times a battery can be charged and discharged over its lifetime] and is typically used in entry-level and mass-market electric vehicles.”

- NMC (nickel, manganese, cobalt): “This chemistry is widely used outside of China, and is commonly found in mid-to-high-end vehicles, such as those from BMW. NMC batteries offer high energy density, which means they provide longer driving range between charges. ”

- NCA (nickel, cobalt, aluminium): “These batteries are designed for very high performance and longer range between charges. They offer excellent energy density and a long lifespan, making them ideal for premium electric vehicles and high-demand applications.”

The choice of battery chemistry is influenced by more than just a technical or cost decision, Bernal says. Various batteries and their ingredients can also reflect growing consumer expectations around sustainability and ethics.

For instance, cobalt is primarily sourced from the DRC, where mining practices have raised concerns around human rights and ethical sourcing. As a result, some manufacturers opt instead for cobalt-free chemistries, such as the LFP battery.

“At present, there is an oversupply of about 200,000 to 300,000 tonnes of lithium carbonate equivalent,” he says. “We are likely to see this imbalance persist for another two to three years. In this environment, success will come down to resilience and whether producers can remain profitable at today’s lower price levels.”

Better batteries, built for Australia

The battery sector, particularly in materials refining and battery-cell production, is dominated by China. However, that hasn’t prevented smaller Australian businesses such as Energy Renaissance from challenging the status quo by building better batteries for Australia’s unique climate and security environment.

Because much of the current battery technology has been developed in China, North America and Europe, it is generally designed for cooler climates. These regions have more developed infrastructure environments in which transport and operating conditions are also not such a challenge, says Lauren Yabsley, chief corporate and operating officer at Energy Renaissance.

“Energy Renaissance designed its battery solutions from the ground-up with the mindset of ‘How do we optimise the technology for a hot climate and challenging operating conditions, and make it easier to install and maintain the battery, while unlocking greater battery capacity performance?’” Yabsley says.

“We also wanted to make sure the batteries were recyclable and able to be repurposed at the end of their life.”

"We have all the key minerals [we need] to make batteries here in Australia, yet we capture less than one per cent of the global battery value chain. Instead of sending raw materials elsewhere, we could be building full battery systems here."

“We worked with the Commonwealth Scientific and Industrial Research Organisation (CSIRO) on developing the technology from both the hardware and software perspectives with those aims in mind. Today, our manufacturing facility in Tomago in the Hunter region of New South Wales focuses primarily on commercial and industrial stationary storage applications.

But the technology goes across a raft of industries, including Australian Defence Force (ADF) applications, and we recently announced the continuation of our work with the CSIRO on a residential battery solution, Renaissance superHome.”

The remote nature of Australian farms, agricultural businesses, work sites, mines and so on means it can be difficult and expensive to have battery technology delivered and installed onsite. To solve this challenge, Energy Renaissance is focusing on delivering a product solution that is flexible to site requirements.

The pre-wired design and product form factor means that once it is forklifted off the delivery truck into place, it is a quick and simple installation.

Software controlling the performance of Energy Renaissance battery racks utilises a thermal management system — a clever combination of fan placement and software that controls the cooling system while monitoring performance — as well as strict cybersecurity protections that guard against interference.

“Because we were working with the ADF, cybersecurity was non-negotiable,” Yabsley says. “If someone takes control of the battery, the chemicals within that battery are obviously highly toxic and can be subject to thermal runaway events and associated fire risk.”

Inside global mining finance with Jairo Bernal CPA

When the battery runs out

There is a great deal of talk around the likely life of an EV battery, Yabsley says. Many believe its life ends at 10 years, but if the battery is well managed and operated in the right conditions, it should have many more years of use.

When a battery is no longer usable, it is important that everything possible is done to recycle and reuse. In fact, Bernal says, the recycling of batteries will become an important way to obtain lithium.

Amazingly, during the lifecycle of a battery, the quality and usefulness of the lithium contained in that cell does not deteriorate. Lithium extracted from a spent battery cell is as useful as it was when the battery was first produced.

“We believe that within the next ten years, the battery-recycling sector will grow,” Bernal says. “The technology is still in its early days, but recycling stations will be absolutely relevant in the sector.”

“Right now, it needs to make more sense from a business point of view. So, the investment is still not there, mainly because we haven’t witnessed a strong need — yet. We don’t yet see massive dumps of batteries, but we will.”

Advanced battery management businesses are factoring this into the design of their batteries, engineering circularity into their products. At Energy Renaissance, this includes manufacturing the batteries in a way that makes them easier to disassemble.

“A lot of battery manufacturers, for example, will laser-weld the cells,” Yabsley says. “This means it’s much harder to break it down and get access to materials such as lithium, and to be able to recycle and reuse that at the battery’s true end of life.”

An energising opportunity

This focus on circularity dovetails with what Yabsley and Bernal see as a current lost opportunity.

“Australia is the largest producer of lithium,” Yabsley says. “We have all the key minerals [we need] to make batteries here in Australia, yet we capture less than one per cent of the global battery value chain.

Instead of sending raw materials elsewhere, we could be building full battery systems here. We have the opportunity to transition and grow our economy while protecting our environment for future generations.”

And the timing could not be better, Yabsley believes.

“We have the highest penetration of rooftop solar in the world, but with that comes the challenge of intermittency,” she says. “Solar firmed with batteries and wind is the solution to cheaper reliable energy.”

“It’s not complex or insurmountable. It’s not one for the too-hard basket. We have the technology and the skills. It just needs a longer-term view and collaboration across parties and sectors.”