Loading component...

At a glance

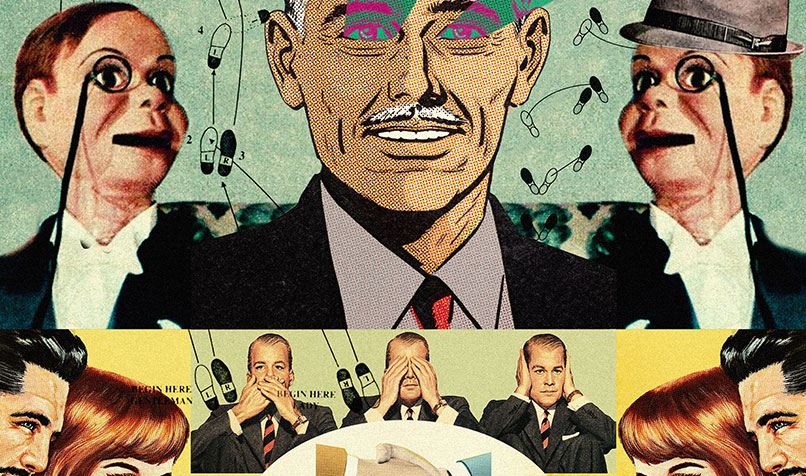

It’s a stereotype that there is an inherent conflict in businesses between the management accounting function and sales, the view being that the conservative, numbers part of the business pricks the sales side’s balloon.

If both can develop a shared perspective of the commercial environment, revenue targets and the steps needed to achieve them, the outcome for the business will be better – and certainly an improvement on a combative relationship between the sales and finance teams.

Before a business can focus on putting the right systems and structures in place to support the most productive relationship between finance and sales, it is important to understand how its backstory affects this dynamic.

Sydney University Business School lecturer Dr Gary Oliver, author of The Managerial Accountant’s Compass, which examines the role and responsibilities of the managerial accountant, says several factors can interplay.

One is the organisation’s longevity. “New organisations can set new performance standards,” Oliver explains. On the other hand, longstanding organisations typically have set performance targets and evaluation methods that formalise the connection between accounting and sales.

"The two areas don't need to meet up all the time, but they need to develop a shared mindset that they are a partnership working towards the same goals."

The business’s financial strength will also make a difference to the way sales and accounting work together, adds Oliver. There’s a very different approach when a business is asset-rich compared to a company with high debt levels and onerous banking covenants.

“This affects the strength of the business’s desire to achieve its cash flow goals,” he says.

Business structure is another factor. Entities with a simple structure, for instance those operated by an owner-founder, will take a different approach from professional services businesses. Hierarchical organisations tend to have more formalised interaction and reporting between sales and accounting.

“In a new organisation, the entrepreneur could be sales-oriented and hire employees who like a challenge. In contrast, in a more established business people’s actions and behaviours tend to be guided by their job descriptions and KPIs,” says Oliver.

Embedding commercial accounting roles in a business

Frieda Maher CPA, principal consultant of sales consultancy SalesPod, agrees the structure of the business is a determining factor when it comes to the link between the accounting and sales teams. She suggests embedding commercial accounting roles in the business to help achieve shared goals. This requires accountability around achieving leading metrics, prospective activities and behaviours that drive sales.

“While accountants don’t generate leads, they can ensure lead metrics are fit for purpose, by backtracking from the revenue target,” she says.

Some of the data that it is essential to measure includes leads coming through the pipeline and sales conversion rates. Measures such as these are essential inputs to targets.

“Accountants can help sales managers understand how these metrics work and how they might measure their team’s behaviours to achieve their target revenue,” Maher explains.

Location, location, location

Where the accountant is situated in the business also matters. In one common model, the accounting function is centralised and located at head office. Alternatively, finance may be co-located with business functions. The model the business chooses will determine how closely sales and accounting work together.

“We don’t have any theory to suggest one is better than the other,” Oliver says.

The nature of the work the accounting function does is also a factor. Oliver explains that in one model, the management accounting function operates as a post office, receiving budget information prepared by each business unit – for instance sales, marketing, human resources and logistics – which it then aggregates into the budget as a whole.

It provides senior management with these figures, and the leadership team will subsequently provide feedback on changes that need to be made to the proposed revenue, cash flow or costs outlined in the budget.

“This is a high-level approach to decision making,” says Oliver, who adds that in this model the accounting function is an information provider, rather than a trusted adviser.

In a different model, the accountant may be a consulting adviser who works with each department individually, including sales.

A case study shows how this works. Let’s say the long-term senior sales manager, who has always achieved great results, is going to retire.

The accountant can provide guidance on the management accounting aspects of both succession planning and recruiting, with recruitment expenditure the key factor. He or she will also be able to consider the impact of this on the sales forecast.

Perhaps the new manager will start in February, and September is the peak sales period. That may give the new manager time to ramp up and reduce any adverse impact on sales.

Many other scenarios may also be true and the accountant can raise the most likely of these and discuss with the team how they may impact sales.

Not all sales roles are created equal

It is important to understand that different sales roles need different behaviours. For instance, the behaviours required from a pharmaceutical sales rep are very different from the actions performed by someone selling building products or complex IT solutions.

Management accountants are adept at understanding this and guiding the sales manager so the business supports and measures the right behaviours for the industry’s requirements.

Accountants can add value in other ways, says Maher. For example, they often have networks across their industry, so they can bring disciplines and capabilities from other areas into their present role.

“I started my career in a low-margin, agile, fast-moving consumer-goods company, then moved to a pharmaceutical company. The disciplines I learned in my previous role were very helpful in the pharma business,” she says.

Accountants can also contribute important insights into the planning and target-setting process, making sure targets are achievable and that the taken by the sales team will allow them to reach them.

Maher cautions businesses against operating in an environment where the “volume fairy” is expected to work miracles – where the data is pointing to a downward trend in volume but management predicts increased sales.

“Accountants can help companies to understand the volume fairy is not coming and there need to be activities to bridge this gap,” she says.

Accountants can help the business set correct boundaries for sales people by explaining and enabling an understanding of the level of discounts the sales team can offer, as well as achieving the right balance between selling on quality versus selling on value.

Above all, says Maher, the optimal relationship between the accounting and sales team requires a true partnership in which everyone understands their role.

Having people in the accounting team with the role of “translator” between the two functions is useful. Those people should use language the sales team understands.

At the same time, the go-between can ensure the sales team demonstrates a true understanding of the leading metrics it needs to hit and the data to collect to demonstrate this.

Someone in the accounting team should also understand the finer details of the sales process.

“The two areas don’t need to meet up all the time, but they need to develop a shared mindset that they are a partnership working towards the same goals. Someone from the accounting team should attend the monthly sales pipeline review meeting and participate in key sales events, rather than simply looking at the revenue outcome the sales team needs to achieve as a done deal,” Maher adds.

Aligning commercial and finance teams to the same songbook

A common problem is a gap between the accounting and sales team’s shared understanding of the sales compensation systems. Both sides must appreciate the way incentives work to motivate the sales team and the potential upside the incentive system can produce for both sales and the company.

Nancy Truscott, director of business development for Australia and New Zealand of benchmarking business Shopper Intelligence, says the most effective teams are those in which there is an alignment in the organisational structure between the commercial and finance sides of the organisation.

She suggests the structure of the finance team should reflect the way sales is structured.

“Have an account focus within the finance team. That will mean both teams have a similar way of communicating and aligned KPIs, linked to the business’s long-term and short-term goals,” says Truscott.

The way lines of communication are established is critical in ensuring a smooth relationship: a direct link is important.

“Everything comes down to a mutual understanding of goals, which requires verbal communication – people in both teams should be picking up the phone and talking to each other,” she adds.

There should also be formal communication systems, such as an agreement about how often joint meetings will be held and the agendas for them, so there are clear expectations about how both sides will work together.

Truscott points out that when both sides are working together in an optimal way, there will be an appreciation of the long view. For instance, let’s say a new customer is trying to negotiate very favourable terms.

Working together, sales and accounting may be able to offer the terms the customer wants by being prepared to give up a small amount of margin in the short-term, if the customer is prepared to agree to a three-year contract to counteract the short-term hit to profit.

She says getting sales and finance working in harmony also means both sides must have access to the right information, updated accurately and in a timely fashion.

“Sharing and collecting information needs to be easy. The sales team needs to be out there selling and they need to be motivated to sell as well – the feeling and approach they take to customers has to be positive and upbeat.

"It’s essential to give them tools that can quickly and easily give them an understanding of where they are from a financial point of view, without their job becoming an admin role. Easy-to-use software with visual outputs works well for sales staff.”

Developing a strong relationship between sales and finance depends on variables such as the business’s age, financial strength and structure.

Whatever the specifics may be, however, the relationship can be enhanced by factors such as good communication and shared goals and objectives. This requires an ongoing commitment to measure what’s working and what’s not and an ability to respond to this feedback for the betterment of the business as a whole.