Loading component...

At a glance

- In attempting to predict what the future will hold post COVID-19 crisis, the greatest obstacle is uncertainty about the pandemic’s trajectory.

- As economies brace for a recession, CFOs in different sectors are working fast to devise measures to alleviate the financial burden faced by their companies.

- In many cases, this involves pivotting operations, confronting problems early, and encouraging a culture of adaptability and collaboration.

By Nina Hendy

The global economy has been in free-fall since the World Health Organization declared the COVID-19 outbreak a global pandemic in March.

Quarantine measures have resulted in business shutdowns, drastic travel restrictions, lost revenue, staff layoffs and disrupted supply chains. Some estimates suggest COVID-19 could cost the global economy US$2.7 trillion.

Heavy-hearted CFOs are being kept awake at night by a global economic crisis few of them would have experienced before.

Uncertainty about the outbreak’s trajectory remains the biggest obstacle for experts trying to forecast what the future might hold.

There are no answers to how long this will last and what the business world will look like on the other side of the pandemic.

A global recession is forecast by most. CFOs have been racing to implement measures to alleviate the financial burden on companies under severe strain, or pivot operations in a bid to stem extraordinary financial losses and get cash into their business.

Economic nosedive

In a clear sign of how quickly things change, a Deloitte survey that took the economic temperature of CFOs around the world at the end of 2019 only hinted at the economic disruption businesses are facing now when the report was released in early March.

It revealed rising uncertainty in CFO sentiment, mostly on the back of negativity about economic conditions in Europe and Asia-Pacific. At the time, improved US-China trade relations were a source of optimism. However, that’s all but disappeared in the space of weeks.

Steve Gustafson, Deloitte Australia partner and CFO program leader, notes that the worst of the bushfire season and the emergence of COVID-19 weren’t captured in the report.

He is quick to point out that business sentiment has fallen significantly as the extent of the virus impact has emerged.

"Really, until we've got a vaccine, our economy is on hold. The 1990s recession was fairly brutal, and I suspect this will continue for a more prolonged period than that."

“Business is under a lot of pressure right now, hence the sentiment would be most definitely negatively impacted if there were a survey now,” Gustafson says.

“We have witnessed companies actively responding to the extreme circumstances they are confronted with. They are working through a myriad of issues, including supply chains, financing, people issues, digital technologies and customer engagement,” he says.

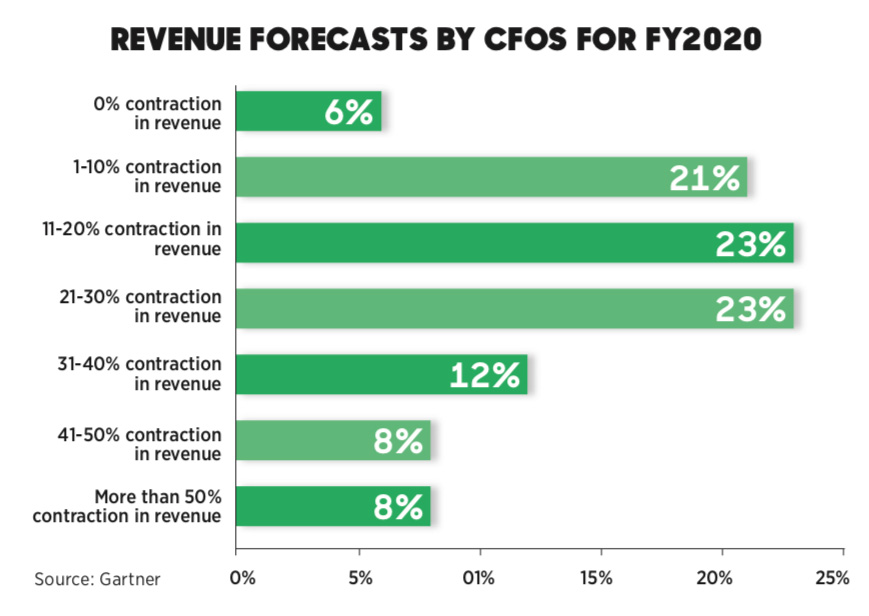

A more recent Gartner survey – conducted at the end of March – reveals that 51 per cent of the respondents are bracing for a revenue contraction of up to 30 per cent this year due to the COVID-19 pandemic; 28 per cent of respondents believe the impact to their organisation’s revenue could be higher than 30 per cent.

Stemming the losses

Ian Broadway FCPA of St Vincent’s Hospital in Melbourne is by no means immune to the fiscal crisis unfolding in businesses around the world. “Things were fairly dire in our sector before this pandemic. It was easily the worst year from a financial perspective since the Kennett [Jeff Kennett, former Victorian premier] era,” he admits.

In mere weeks, St Vincent’s Hospital followed government orders to cancel non-urgent surgeries and prepare for an influx of COVID-19 patients.

In the last 10 days of March, the hospital’s financials were hit hard as A$3.5 million to A$4 million in costs and lost revenue bled from the bottom line.

The costs involved keep him awake at night. “We’re a surgical hospital, and we’ve changed the whole nature of our hospital to be a general medicine hospital in three to four weeks, which is both challenging and costly,” he says.

“If you were in manufacturing, it’s like one day making cars, and the next day you’re making trucks.”

The slow burn of the virus means it will take longer to get back to normal. “Really, until we’ve got a vaccine, our economy is on hold. The 1990s recession was fairly brutal, and I suspect this will continue for a more prolonged period than that.”

The financial pandemic

Businesses in Asia are in a similar boat.

In Singapore, ASX-listed textile and apparel company GLG Corp. is under immense pressure after unprecedented retail store closures across the US – home to the majority of its customers.

Orders have been postponed, resulting in suspensions in production at some factories. The company’s CFO, Victoria Yong CPA, isn’t counting on good news until next year.

She admits she’s battling excess inventory, deferred orders and a cash crunch. She has been working with several financial institutions to increase the company’s revolving credit lines.

To mitigate the financial impact, the business has converted existing production lines to produce reusable antibacterial fabric masks with current fabric inventories. This has generated interest from new and existing customers in the US, Europe and across Asia.

“Our Prime Minister, Lee Hsien Loong, has mentioned that the economy will definitely take a hit for the next few quarters. He’s warned that a recession could be a possibility,” Yong says.

Glimmers of hope

Despite the grim scenario they find themselves in, many CFOs admit there are glimmers of opportunity on the horizon.

In Malaysia, Wayne Treeby FCPA, CFO of leading mobile network Maxis, has reverted to a few simple operating principles to navigate this complex time.

“Table problems early, encourage devil’s advocacy and collaborate. These are inherently risky times, unprecedented mostly, and unless you can act quickly, move away from group thinking by challenging the norm and get buy-in from all parts of your organisation, you will find yourself left behind,” Treeby says.

“For those brave enough to act effectively now to stabilise and protect your business and maintain liquidity, opportunity will come,” he says.

John Stanhope FCPA, former CFO of Telstra and former chair of Australia Post, is quick to point out that this isn’t a financial crisis, but a pandemic.

One of the big unknowns is how and over what time period the government will move to recover the debt created during the pandemic stimulus, Stanhope says.

Government stimulus payments will keep economic activity ticking over during the hibernation period, providing some hope.

“After this ends, we are likely to be working in different ways, such as more business online. We will also need to adjust to customer behaviour changes, and those who adjust the fastest will prosper,” he says.

Treeby is also cautiously optimistic that Maxis will sail through the storm, despite not knowing its length or severity.

“I’m confident we have acted effectively and taken appropriate actions with plans in place to protect our people and our business, maintain liquidity and be ready to explore growth opportunities as they arise,” he says.

Steadying the ship in the storm

Former White House Chief of Staff and Chicago Mayor Rahm Emanuel once famously said: “Never let a serious crisis go to waste”– and those words are now ringing in the ears of New Zealand finance guru Matthew Needham FCPA, who is deputy chief executive of finance for Kainga Ora – Homes and Communities, which is a government-owned entity that houses about 190,000 New Zealanders.

Needham says CFOs have an opportunity to rebuild businesses in more efficient ways post-pandemic.

He is encouraging CFOs to have regular meetings with people leaders and teams, with plenty of technology for connecting and collaborating with each other available, such as Zoom, Yammer and Trello.

“In the event that the COVID-19 pandemic hangs around for a while and we have to adopt different ways of working, think about what you need to do and what’s the best way to do it. It may well be completely different to how you used to work,” he says.

Simplifying bureaucracy has been high on his agenda. Within a few days of the lockdown, the business revisited delegated financial authorities in case a key financial staff member was struck down with COVID-19.

"The challenge of finding new ways of doing things and being creative with use of technology, for example, is also promising."

Payment timeframes to suppliers have also been reduced to just a few days. He’s been considering rolling or continuous forecasting. Getting physical signatures on documents is impossible – the company has had to change and adapt.

Yong adds: “It’s also a good time to maintain and extend networking during this circuit breaker period, and enrol in self-enrichment courses for when operations normalise.”

Meanwhile, Stanhope urges CFOs to implement more refined reporting to the board. Resilience scenarios for audit and risk committees are crucial to help businesses through these uncharted waters, he says.

“Good companies will have tier-one strategic risk analysis that CFOs should present to boards to help them understand how these risks are moving, and the proposed mitigants in the dynamic situation in which we find ourselves,” Stanhope says.

“Lastly, and more importantly, strategise what the business can look like post-pandemic and what new opportunities might unfold,” he adds.

Cup half full

There’s plenty of evidence of financial leaders already quietly plotting how their respective businesses will work after the pandemic ends. They’re considering which systems and processes are really essential, and whether there’s a better way to work in the future.

Broadway’s challenge will be putting St Vincent’s Hospital back together again without adding back inefficient services. “I see this as an opportunity. The scope of telemedicine and treating people at home are innovative ways of solving problems, for example.”

Gustafson says: “There are a number of scenarios for how we may emerge from this crisis, and those who were able to survive the recent bushfires and adapt to these new conditions will be stronger for it.”

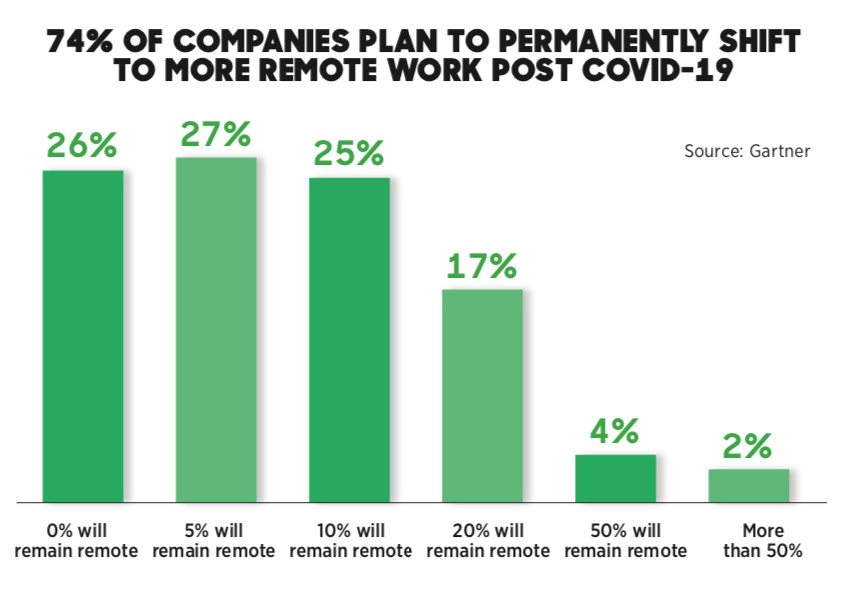

One survey by Gartner reveals that finance leaders are considering reducing the need for office space by permanently shifting a portion of employees to working remotely.

What was once considered a perk for senior employees is now a lifeline for countless companies scrambling to keep operations running amid social distancing measures.

Bradley Francis FCPA, CFO of Edith Cowan University, admits he’s optimistic given that Australia’s response to COVID-19 compares favourably with much of the rest of the world at the moment.

“The challenge of finding new ways of doing things and being creative with use of technology, for example, is also promising,” he says.

In Auckland, Jacky Hollingsworth CPA, CFO of Auckland Tourism, Events and Economic Development, is also cautiously optimistic. She urges others not to make decisions in haste, saying they can have unintended consequences that can’t be rectified.

“I’m under no illusion that the months ahead are going to be extremely difficult to manage. It’s hard to realise that some businesses won’t make it through, but adversity and change can bring new opportunities in many forms for other firms.

“We may feel we need to make dramatic changes if we are in survival mode. However, well thought out incremental steps can often support an organisation to adapt with minimal collateral damage and often result in stronger organisations later.”

Advice for CFOs

Money: Actively monitor cash flows.

Be picky: Mergers and acquisitions – look for the diamonds.

Be direct: Communicate directly, consistently and regularly with teams, stakeholders and mentors.

Plan ahead: Consider different scenarios that the government may use to improve the economy.

Learn: Be prepared to accept and learn from mistakes and make the necessary changes quickly to correct them.

Look ahead: Keep an eye on emerging and unexpected risks as businesses adapt quickly.

Source: Bradley Francis FCPA, CFO, Edith Cowan University.