Loading component...

At a glance

There are 12 million people in the Australian workforce. Do 6.3 million of them need to claim laundry bills as a tax expense?

Australian Taxation Office (ATO) commissioner Chris Jordan has flagged a crackdown on claims for work-related expenses (WREs), suggesting a significant loss to revenue from a large number of taxpayers overclaiming small amounts.

Australians claimed about A$22 billion in WREs in 2014-15, he told Canberra’s National Press Club in July 2017, thereby ensuring the nation’s media would relay the message to taxpayers.

The ATO followed up two weeks later with assistant commissioner Kath Anderson issuing a warning to taxpayers to take more care in claiming deductions.

Anderson says claims for clothing and laundry expenses have risen by 20 per cent over the last five years and 1.6 million people claim a deduction of exactly A$150, perhaps in the mistaken belief that they can claim it without having spent the money.

Are taxpayers overclaiming?

The ATO’s messages were well-timed, as PAYG earners gathered their receipts for tax time but incurred a backlash from those who believed the ATO was trying to scare taxpayers away from claiming legitimate deductions.

A month previously, an inquiry into tax deductibility by the House of Representatives Standing Committee on Economics had rejected proposals to abolish WRE tax deductions, saying claims for valid expenses were “an entirely appropriate part of our taxation system”.

“WRE deductions represent only 4 per cent of individual and other withholding tax revenue. This means that even the complete abolition of WRE deductions would only cover the cost of a very modest reduction in personal income tax rates,” says its report.

The committee recommended that the ATO analyse each detailed subcategory of tax deductions and identify areas that could be open to systemic abuse and overclaiming.

“The ATO should then rank these subcategories in order of the size of the financial risk they represent to Government revenue, and recommend amendments to law or policy where appropriate,” says the report.

Richard Highfield, an adviser on tax system design and administration to the OECD and a member of the expert panel advising the ATO on tax gap, told the committee the incidence of over-claimed deductions could be around 15 per cent, which for 2014-15 tax returns would represent around A$3.5 billion of overclaimed deductions and $700 million to $800 million of tax revenue.

Tax agents prepare most individual tax returns

CPA Australia questions how much overclaiming is happening when 74 per cent of individuals’ tax returns are prepared by tax agents, and says more work needs to be done if this is the case.

In 2015, the average claim from people preparing their own tax return was A$2000 while claims submitted by tax agents averaged A$2600.

“People have a right to claim legitimate expenses,” says CPA Australia head of policy, Paul Drum FCPA.

CPA Australia told the inquiry that most Australian businesses are small businesses and not all can afford to provide all tools and equipment for their employees.

WREs should not be attacked as a tax simplification or budget revenue measure, it said. If a standard deduction were to be introduced, there would be “windfall winners” among people with few claims, and losers among those employers did not cover all their expenses.

Do taxpayers know what expenses they can claim?

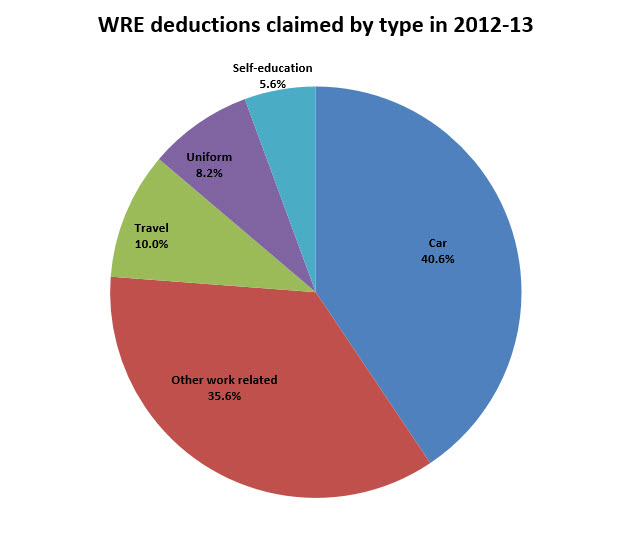

WREs were the most common personal tax deduction in 2012-13, comprising about 63 per cent of the value of total deductions, according to a report the Parliamentary Budget Office (PBO) prepared for the inquiry.

ATO figures show 8.6 million people claimed WREs in 2014-15.

In March 2017, the ATO told the inquiry that while the amounts overclaimed by individuals were relatively small, “they add up across the large population of individual taxpayers”.

In reporting, the committee said it was concerned that the ATO could not quantify the actual cost of WREs to the budget and recommended that Treasury estimate the cost to government revenue.

The PBO did an analysis for the committee, however, and estimated revenue forgone of A$8.3 billion in 2016-17 and A$8.74 billion in 2017-18.

The ATO told the inquiry the tax gap panel would meet later in 2017 and it might have some figures then.

Do other countries allow work-related expense claims?

A 2009 Treasury review of how other jurisdictions treated work expenses claims found Australia’s system “relatively generous”.

New Zealand does not allow claims by employees and in the UK expenses must be incurred wholly, exclusively and necessarily for work.

US taxpayers have the option of claiming a standard deduction in lieu of itemising deductions. The amount is adjusted every year and for 2017 is US$6350 for single people and US$12,700 for couples filing jointly.

Drum says countries that allow a standard deduction have usually made it relatively large – more than a few hundred dollars – while those that dropped WRE deductions did so as part of wider tax reforms that involved large cuts in personal income tax.

He says Australia already has a form of standard deduction in the A$300 of WREs not subject to substantiation.

“This $300 amount was introduced in the late 1980s and has never been increased,” he says.