Loading component...

At a glance

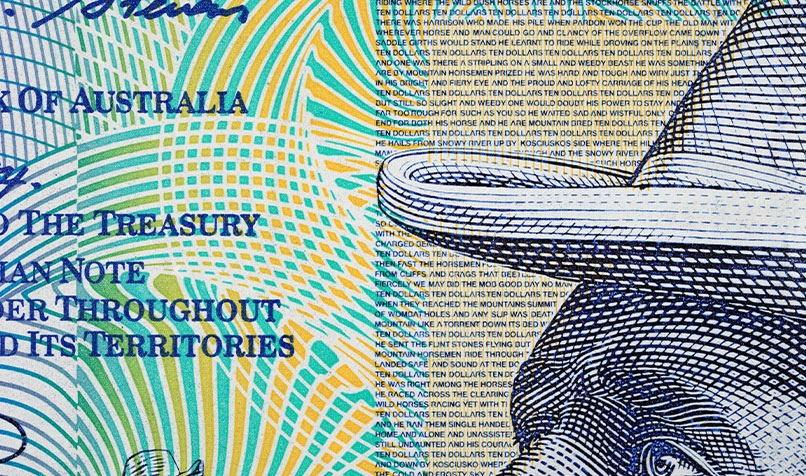

- Payroll tax revenues total nearly A$27 billion a year and are administered by the states and territories.

- Widely regarded as a tax on jobs growth, payroll tax can influence how willing a business is to employ new staff.

- Reform options include increasing the goods and services tax or adopting other broad-based taxes.

By Gary Anders

Payroll tax on wages was first introduced by the Australian federal government back in 1941, at a flat rate of 2.5 per cent, to finance a national endowment scheme for the children of fallen soldiers.

Control of payroll tax was passed to the states and territories in 1971 to provide jurisdictions with revenue for their expenditure on services and infrastructure, with the flat tax rate then uniformly lifted to 3.5 per cent.

Across Australia, payroll tax revenues now total nearly A$27 billion a year, representing between 27 per cent and 40 per cent of state and territory revenues.

To put that into greater context, Australia ranks third among the 38 member countries of the Organisation for Economic Co-operation and Development (behind Sweden and Austria) in the share of government revenue contributed by payroll tax.

Pain points

The application of payroll tax has evolved over time. Only businesses with wages bills that exceed specific monthly thresholds need to pay payroll tax, but the thresholds vary by jurisdiction.

As such, businesses operating in multiple states and territories have added layers of complexity in managing their tax affairs.

In addition to the compliance and administrative burden payroll tax presents, it is also widely regarded as having an adverse effect on business profitability, competitiveness and jobs creation.

“It is a tax on jobs growth,” says Jenny Lambert, director economics, employment and skills at the Australian Chamber of Commerce and Industry (ACCI).

“For those businesses over or near the thresholds, every additional employee costs more in tax.”

The ACCI recently released a paper entitled Payroll Tax: A handbrake on jobs & investment following a national survey of 620 of its members.

"Payroll tax is complex, extremely inefficient and distortionary. The proliferation of rates and scaling, tax-free thresholds, discounts and exemptions, as well as definitional differences and grouping arrangements, places a high administrative and compliance burden on business."

It found that businesses ranked payroll tax as the highest reform priority relative to other government taxes, fees and charges, workplace relations and regulation.

More than 90 per cent of the businesses surveyed said that payroll tax influenced their willingness or ability to employ staff and invest.

In addition, more than half said they would increase their number of employees, and 20 per cent said they would increase employee wages if payroll tax was abolished.

“Payroll tax is complex, extremely inefficient and distortionary,” Lambert says.

“The proliferation of rates and scaling, tax-free thresholds, discounts and exemptions, as well as definitional differences and grouping arrangements, places a high administrative and compliance burden on business.

“It is not connected to profit but based on wages paid. As we saw during the COVID-19 crisis, when businesses weren’t generating an income, let alone generating a profit, they continued to incur a payroll tax liability.”

Eyeing taxation reforms

Jennifer Westacott AO, chief executive of the Business Council of Australia, says it is time to have a conversation about making Australia’s tax system more efficient so it supports the economy to grow faster than forecast.

She says this means having a more competitive taxation system and working with the Commonwealth and states “to remove productivity sapping and pointless state taxes like stamp duty and payroll tax”.

“This will involve some difficult questions, some tasks and a massive conundrum – who should do what in the federation, and who should pay for what?

“There’s no doubt our federation is littered with duplication, a lack of efficiency and confusing systems.”

Westacott says harmonising payroll tax bases is one of the first steps towards more efficient state tax systems.

Warren Hogan, managing director of EQ Economics and economic adviser to Judo Bank, says it is a longstanding fact of the Australian economy that payroll tax is an inefficient tax.

“It’s a tax on labour, so it’s effectively just another way of increasing non-wage labour costs for business,” he says.

“There is evidence from around the world that suggests that it may result in less employment and lower wages.”

Hogan says tax reform can be achieved with the introduction of new broad-based taxes, which have a minimal impact on the effective operation of the economy.

“Then, get rid of a lot of these historical taxes that do have an impact. We saw a lot of those state-level taxes go with the introduction of the GST [goods and services tax]. Unfortunately, payroll tax was not one of them.”

Increasing the GST?

Lambert adds that transition costs are the biggest obstacle to achieving any substantial payroll tax reform, requiring the Commonwealth to play an active role in offsetting lost revenue and incentivising the states and territories to make significant changes.

“One option available to governments would be to increase the goods and services tax to support state and territory budgets,” she says.

In the ACCI survey, to replace state and territory revenue, just over 85 per cent of businesses said they supported increases in Commonwealth taxes, with the majority (58 per cent) supporting an increase in the GST.

“States and territories should also be looking to develop an alternative means of self-source revenue,” Lambert says. “Recent progress by New South Wales and the ACT on stamp duty reform, looking to increase land tax to replace stamp duty, are examples of approaches that can be taken.”

Hogan says any significant reform of payroll tax, or its elimination, would ultimately need to be part of a larger tax reform package.

“I doubt it would be able to happen without being part of an increase in the GST,” he says.

“It’s a tricky one, but I think it’s going to have to be a discussion we have at some stage. Because apart from wanting to look at how we can improve the efficiency of the tax system, we need to think about how the federal government and state governments are going to get their budgets back into order.”

"It’s a tax on labour, so it’s effectively just another way of increasing non-wage labour costs for business. There is evidence from around the world that suggests that it may result in less employment and lower wages."

Hogan says he’s not confident this can be done without an increase in the GST rate.

“As soon as you begin that conversation at a national level, then you have to think about what other reforms need to be done, such as the removal of payroll taxes that would benefit the economy.

“In a way, this payroll tax issue, which has been hanging over the economy for generations, there is some chance it could be brought back onto the table in the next few years if the GST is brought back onto the table.

“There’s nothing like a good crisis to get something happening, and if indeed we get to a point where we have some issues with our government finances in the next few years, then payroll tax may come into play.”

Elinor Kasapidis, CPA Australia’s senior manager tax policy, agrees the Australian tax system as a whole – both at the federal and state level – does need a review.

“The challenge with tax reform, when you only look at payroll tax in isolation, is there’s only so much you can do,” she says.

“Certainly, when you look at whether we should even have payroll tax, for example, there may be better ways to improve our productivity and competitiveness.

“Removing payroll tax might be one of them, but also the states do need to have revenue for education and health services.

“So, the broader question is, where else will the money come from? If you change the payroll tax ratio and the amount of money the states and territories get, we need to make sure we can still fund the services that governments give to us.”

Steps to simplify processes

The design and application of payroll taxes across Australia’s different government jurisdictions add to the cost of compliance for many businesses.

For one thing, there is no simplified digital system available for businesses to make payroll tax payments.

That compares with the federal government’s Single Touch Payroll system, which is a single, national system for managing employees’ personal income tax and superannuation payments.

“With the previous government, there was an announcement to share Single Touch Payroll information with state and territory revenue offices,” says Kasapidis.

“It was a small step in the right direction. We’d like to see initiatives like that progress, and certainly we’d like to see the states talk with each other about harmonising their regimes.

“There are a lot of good ideas out there, but we’re just not seeing much movement.”

Kasapidis says that even if there is no wholesale change to payroll tax, CPA Australia would like to see steps taken to make it simpler, easier and clearer, particularly for businesses that operate across states.

“At the moment, the states are operating outside of the Single Touch Payroll system.

“What we’d like to see is all of it brought into Single Touch Payroll, and that way digital service providers would have the functionality to make it easy for businesses.

“The reporting and payment would be through a single portal. Hopefully, a lot of the definitions and classifications would be the same.

“We see that as the most practical step to take forward, while the broader issues about whether we have a payroll tax and how our tax system should be reformed – that’s going to take a little while longer.”

Kasapidis says this would make everything much more efficient and lower costs for businesses as well for each state and territory.

“It’s certainly about calling on the states to work together. We respect that they need to source revenues and set their own tax policies. However, any efforts to make it easier and simpler, that’s what we’re looking for them to do.”