Loading component...

At a glance

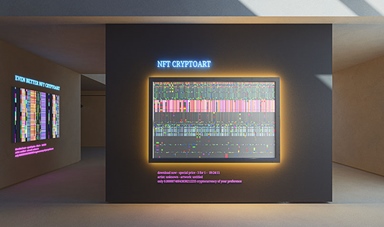

NFTs have become big business very quickly, with crypto investors and bitcoin millionaires spending millions on assets and collectibles that exist only in the virtual world. Are NFTs another fad? It seems not.

NFTs are unique digital identifiers attached to a digital asset with the purpose of guaranteeing authenticity and conferring ownership.

NFTs gained widespread attention in March this year when international auction house Christie’s auctioned a collage of JPEG images by digital artist Beeple for US$69.3 million (A$89 million) worth of cryptocurrency Ether.

Soon after, another global auction house, Sotheby’s, achieved US$16.8 million (A$21.5 million) for a digital art collection, “The Fungible” by an anonymous creator, Pak, in a novel experiment using blockchain technology.

The NFT difference

Unlike cryptocurrencies or other “fungible” (or mutually interchangeable) assets, NFTs are unique assets that cannot be exchanged equally for another in-kind asset, explains Caroline Bowler, CEO of BTC Markets, an Australian cryptocurrency exchange.

It is this unique nature that confers value to an NFT. When Twitter co-founder and CEO Jack Dorsey created an NFT for his first-ever tweet – of which there is only one original – he was able to sell it for US$2.9 million (A$3.7 million).

NFTs are created on the Ethereum Blockchain, the world’s second-largest cryptocurrency platform.

“It effectively assigns an NFT to an item, which is then stored in the owner's digital wallet or taken to a marketplace where it can be sold or ownership can be transferred to another wallet,” Bowler says.

Leigh Travers, CEO of Perth-based blockchain agency DigitalX, says the process of buying NFTs is fairly straightforward.

“If you want to buy an NFT, you can go to an NFT marketplace, or buy directly from a website selling NFTs,” he says.

“You then connect your digital wallet, such as MetaMask, to the website. You can use Ether, Ethereum’s cryptocurrency, or Tether, a stablecoin linked to the US Dollar, to acquire the NFT.”

Popular open marketplaces for crypto collectibles, such as Rarible and OpenSea, have grown exponentially, reaching US$1 billion (A$1.2 billion) in sales.

Fad or fantastic?

NFTs are not new and have existed for several years. CryptoKitties, the digital kitten collectibles that were all the rage in 2018, are an example of early NFTs.

What is new is the high-profile art auctions and celebrity interest in NFTs, which have led to the hype around these digital assets.

As a result, the NFT industry has seen a 25-fold increase in trading volume, while valuations for cryptocurrencies have exceeded US$2 billion (A$2.6 billion) at the time of writing in June 2021.

All this suggests it is not a passing fad, but the beginning of a revolution, says Travers.

“The value of NFTs is supported by the technology that can create digital scarcity and ownership, tapping into the human desire to own things of scarcity and unique value.”

The problem with the online world is that everything can be copied. “If you create digital art, it can be copied, and then shared a million times over the internet,” Travers says.

With NFTs, it doesn’t matter how many replicas of digital art are available online, because NFTs “provide a way to assign each unique digital asset, like a piece of art, with a digital signature to prove ownership of the original”.

Travers says, as we spend more and more time online, NFTs offer a way to showcase power, wealth and influence within an online network in a way similar to traditional social settings.

NFTS: A brave new world?

It can be hard to predict how the NFT future might play out, but the rough outlines of this new economy are already taking shape.

“The interest in NFTs reflects a maturity of the market – and a market that still has some distance to go – in terms of what is possible and currently available with the blockchain economy,” Travers says.

For example, even though all major digital assets are becoming more stable, Bitcoin is still around six times more volatile than the stock market, he says.

NFTs are different, because their value is in the assets underneath, but the decision to invest in NFTs must be based on sound judgment and desired outcomes.

“If you're a trader looking to come in and trade in this marketplace, I think that's a terrible idea," Travers says.

“I think it is better to find something that you like, and buy and hold it for a long term, or buy it so you can use it.”

Another consideration is that NFTs are taxable.

“Australia is probably the worst place to issue NFTs, because of the income tax accrued at the point of sale, and where there may be a liability that will accrue to this issuer over a longer period of time,” says Travers.

According to Bowler, "NFTs are important to investors and our economy, acting as bellwethers for what is to come in the blockchain economy.

"NFTs matter not for where they are today, but for where they are directing our future."