Loading component...

At a glance

- Many of Australia’s tech start-ups tend to fall outside the definition of companies that qualify for the government's JobKeeper payment.

- Intellectual property is one of their main growth drivers, but many of these companies have been forced to cut down on their talent pool.

- In the long term, this could have a significant, negative impact on the tech sector in general.

By Dr Jana Schmitz

In October 2019, the Australian Senate Select Committee on Financial Technology and Regulatory Technology commenced its inquiry into the Australian Financial Technology (FinTech) and Regulatory Technology (RegTech) sector. The inquiry’s terms of reference include current practices, barriers to technology uptake and the effectiveness of current initiatives in promoting a positive environment for FinTech and RegTech start-ups.

Since the committee finished its last round of public hearings in February 2020, the economic environment in Australia has changed noticeably due to the COVID-19 pandemic.

Therefore, the committee announced that it would like to hear “what support is necessary in the short, medium and long term, including post-recovery, focusing on solutions that can be delivered swiftly by government and the private sector”. The submission deadline was extended to 10 April 2020.

Government COVID-19 stimulus packages have created great uncertainty for tech start-ups in Australia. CPA Australia identified the eligibility criteria of the Australian Government’s JobKeeper scheme as one of the core problems faced by tech start-ups. Many start-ups rely on contractors, casuals or staff on temporary visas, typically employed on an on-demand basis, often for less than 12 months.

Consequently, several major tech start-ups have been forced to lay off key staff, which has caused further challenges in maintaining and expanding the businesses. Intellectual property is the main growth driver for start-ups. When start-ups are forced to let go of their vital talent pool, it can have devastating effects on their businesses and the Australian tech sector in general.

These issues, among others, were named by FinTech Australia, which represents more than 300 Australian start-ups and FinTechs, in its supplementary submission to the Senate inquiry. FinTech Australia’s submission focuses on the need for short and longer-term support from the government to help the Australian FinTech sector become and remain internationally competitive into the future.

Some of the recommendations propose bridging finance tied to a two-year repayment timeframe, conditional on start-ups not laying off employees, and the bringing forward of the government’s research and development incentive payments. FinTech Australia emphasises that “the time to act is now in order to prevent an irreversible market shock to the FinTech sector”.

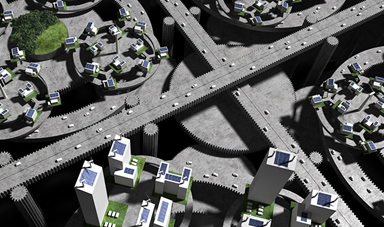

With companies across sectors having become increasingly dependent on technology, often using software services provided by tech start-ups, technology is most likely to become the engine of the new economy.

In the global race for technological advancement, several jurisdictions, including Singapore, France, New Zealand, the UK, the European Union and Hong Kong, have recognised the opportunities technology offers to help their economies recover and prosper in the post-pandemic world. These jurisdictions have implemented extensive measures to specifically support FinTechs and other tech businesses.

For example, the UK Government has offered start-ups a lifeline, with a £1.25 billion (A$2.3 billion) package aimed at maintaining innovation during the COVID-19 pandemic, and to help young companies survive in a difficult economic climate. The French Government has committed €4 billion (A$6.6 billion) to the start-up sector, as part of a larger €300 billion (A$493 billion) commitment.

This includes loans to guarantee wages of start-up employees for up to two years and fast-tracked tax returns. Further, addressing the need for technological advancement in general, the government of Hong Kong has launched the “Distance Business Programme (D-Biz Programme)”, as part of its Anti-epidemic Fund, to fast-track funding for companies to adopt remote working IT solutions.

In its February 2020 submission to the Select Committee on Financial Technology and Regulatory Technology, CPA Australia emphasised that lessons could be learned from other FinTech-leading jurisdictions. The 17 recommendations in the submission by CPA Australia’s are partly based on a research study conducted by Scientia Professor Ross Buckley and Dr Anton Didenko from the Faculty of Law at the University of New South Wales (UNSW), commissioned by CPA Australia.

CPA Library resource:

While most recommendations focus on medium to long-term measures – including increased access to capital, improvement of immigration and talent policies, introduction of flexible and adaptable regulatory frameworks, enhancement of international FinTech and RegTech collaboration, and maintenance of a flexible tax framework - CPA Australia has emphasised the crucial need for temporary measures to keep start-ups alive.

Temporary or short-term measures tailored to tech start-ups will have a far-reaching impact on the Australian economy as technology increasingly supports several sectors driving Australian exports, including education, agriculture and energy.

With companies across sectors having become increasingly dependent on technology, often using software services provided by tech start-ups, technology is most likely to become the engine of the new economy, contributing to Australia’s economic recovery and creating jobs. Policymakers must support the recovery and strengthening of Australia’s tech start-up space, or risk wasting years of progress and losing market share to international competitors.