Loading component...

At a glance

By Melody Tan

The expansionary budget, dubbed Emerging Stronger Together, will see the country dip into its past savings for a second consecutive year to fund measures needed to fight the pandemic.

Altogether, the total draw on its reserves will total S$53.7 billion over two financial years in 2020 and 2021.

Unveiling the latest budget, Deputy Prime Minister and Finance Minister Heng Swee Keat said the measures would support initiatives to drive sustainability, digitalisation and innovation, and help businesses and workers succeed in a post-pandemic future.

The government expects an overall budget deficit of S$11 billion, or 2.2 per cent of gross domestic product, for Fiscal Year 2021 that begins in April.

“In the immediate term, running a fiscal deficit to support targeted relief is warranted, considering the unprecedented impact of COVID-19,” said Heng.

Expansion of support to mitigate COVID-19’s ongoing impact

Outlining the challenges that Singapore faces, Heng said the country’s economic recovery remained contingent on the global economy – the fate of which remains uncertain.

He emphasised that Singapore must remain nimble and able to adapt to a wide range of possible scenarios, adding: “Since our independence, we’ve weathered numerous crises. As Singaporeans, we can once again summon our resolve and emerge stronger from this unprecedented crisis.”

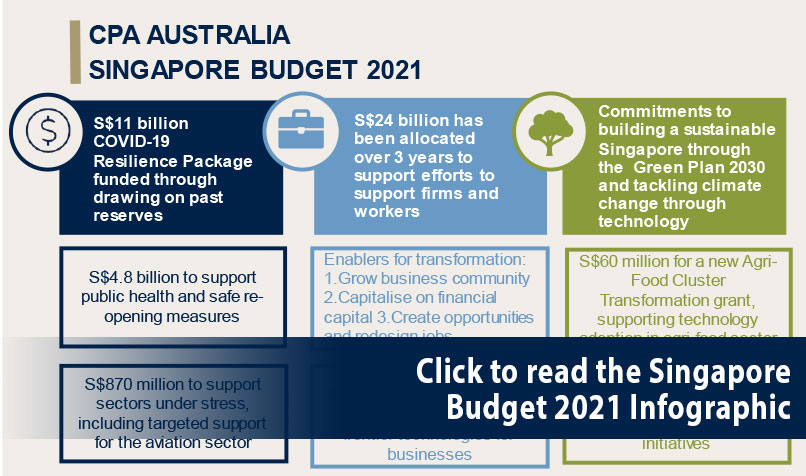

A centrepiece of Budget 2021 involves an S$11 billion COVID-19 Resilience Package aimed at safeguarding public health, supporting workers and businesses, and providing targeted support for sectors still facing stress from COVID-19’s economic impact.

Heng added that together with the Budgets announced in 2020, the COVID-19 Resilience Package was about “preservation and adaptation – to safeguard lives, jobs, supply chains and core economic capabilities.”

To fund the package, the government will draw a further S$1.7 billion from past reserves, with the remainder coming from the unused portion totalling S$9.3 billion from last year’s S$52 billion of reserves withdrawal.

Heng said that this second consecutive year of drawing on the national reserves was necessary given the exceptional circumstances. As a result, Singapore’s fiscal situation in coming years is expected to be tighter. He said the overall fiscal strategy must return to running balanced budgets, when possible.

“It was fiscal prudence and discipline that allowed us to accumulate our national reserves, which has enabled us to respond decisively to this crisis,” he said.

Of the COVID-19 Resilience Package’s S$11 billion, S$4.8 billion will be allocated to public health and safe reopening measures, and $870 million will go to the aviation sector to maintain its core capabilities in preparation for an eventual recovery.

The land transport sector will receive S$133 million in the form of continued support for the COVID-19 Driver Relief Fund, while the Arts and Culture Resilience Package and Sports Resilience Package will receive additional funding of S$45 million.

The Jobs Support Scheme (JSS) will be extended, with the hardest-hit sectors such as aviation, aerospace and tourism – categorised as Tier 1 – receiving 30 per cent support for wages paid from April to June this year. From July to September, the wage support will drop to 10 per cent.

Tier 2 sectors – which include retail, food services (excluding supermarkets) and the built environment – will receive 10 per cent of wage support from April to June, while Tier 3A sectors will have their JSS assistance ended in March. The total cost of the JSS extension amounts to S$700 million.

Transforming workers and businesses via community, capital and job redesign

While tackling the immediate term COVID-19 challenges, Budget 2021 also has its eye firmly on Singapore’s future.

Over the next three years, the government will also invest S$24 billion in transforming workers and businesses in three key areas: growing a vibrant business community, catalysing a wide range of capital to enable businesses to transform and scale upwards, and creating opportunities by redesigning jobs to ensure Singaporean workers can realise their full potential and aspirations.

“The efforts will span several years,” said Heng, “but it is crucial that we start today. This builds on the momentum of the transformation push started five years ago, when we launched our Industry Transformation Maps.”

As part of building a vibrant business community, Heng announced that the government would invest in three key platforms to help businesses innovate – the Corporate Innovation Launchpad, aimed at helping larger businesses to rekindle a start-up mindset by engaging in new ventures; the Open Innovation Platform, which facilitates the matching of companies to solutions providers; and the Global Innovation Alliance, which drives cross-border collaboration between Singapore and overseas entities.

Strengthened partnerships with ASEAN countries was also part of the government’s overall strategy to assist Singaporean efforts to plug into global and regional supply chains.

Heng noted that Singapore would continue to work closely with ASEAN to enhance digital connectivity and cybersecurity via initiatives like the ASEAN Smart Cities Framework, as well as continue partnerships on cross-border projects in areas like electronics, medical technology and food processing to meet rising demand in the region.

To give Singapore businesses more access to the capital needed in order to innovate, transform and scale, the government will step up risk sharing arrangements with capital providers and provide grants throughout the various stages of a business’s growth, with the Enterprise Financing Scheme’s Venture Debt Programme’s cap on loan quantum increased from S$5 million to S$8 million.

A total of S$1 billion will be dedicated to enhancing the support levels of schemes like the Productivity Solutions Grant and the new Emerging Technology Programme, which will provide co-funding for the adoption of frontier technologies by businesses.

In the area of jobs redesign, the government is extending assistance to include large local enterprises which might have difficulty attracting funding in the current environment.

A sum of S$500 million – which will be matched one-for-one by Singapore’s sovereign wealth fund Temasek Holdings for a total of S$1 billion – will ensure growth capital remains available for these companies to transform their businesses.

To benefit workers, the SGUnited Jobs and Skills Package will receive an additional S$5.4 billion, in addition to the S$3 billion allocated last year. Of the additional amount, S$5.2 billion will be allocated to the Jobs Growth Incentive, extending the hiring window by another seven months to end September.

Companies that hire mature workers, workers with disabilities or ex-offenders will receive up to 18 months of support.

To meet the demand for leadership in the fast-growing sectors of deep technology and enterprise, the National Research Foundation will support 500 participants under the new Innovation and Enterprise Fellowship Programme, which will work with start-ups, tech accelerators and venture capital firms to develop leaders in tech fields.

Heng announced the need to support skill transfers from foreign workers to locals, extending the 15 per cent co-funding Wage Credit Scheme for a year.

The government will also continue to review the S Pass framework, stating that the manufacturing sector’s S Pass quota will be cut from 20 to 15 per cent over the next two years.

He emphasised that firms must make it a priority to develop a strong, highly skilled local core in their workforce.

Sustainability through technological innovation and shifting consumer behaviour

Sustainability was a large focus within the Budget, in line with the announcement of the Singapore Green Plan 2030. Technology is expected to open new possibilities to achieving sustainability.

“As demand for green products and technologies increase globally, businesses can seize new opportunities for growth,” said Heng.

To drive technological innovation in the sector, he announced that S$60 million would be set aside for the Agri-Food Cluster Transformation Fund, which replaces the Agriculture Productivity Fund.

He also outlined the expansion of Singapore’s electrical vehicle (EV) infrastructure, the matching of road tax rates to internal combustion engine vehicles and the lowering of the Additional Registration Fee to zero for EVs.

To shift consumer behaviour towards environmentally friendly alternatives, Heng announced that petrol duty rates would increase with immediate effect. Premium grade petrol duty will go up by 15 cents per litre, while intermediate grade petrol duty will increase by 10 cents per litre.

This will be offset by a one-year road tax rebate ranging from 15 per cent to 100 per cent for cars, motorcycles, buses and goods vehicles, as well as other rebates for motorcyclists, taxi and private-hire drivers.

Pledging that the government would lead by example in committing to more ambitious environmentally-targeted goals, Heng said the government will issue up to S$19 billion in green bonds for a pipeline of public sector infrastructure projects.

It will also explore borrowing up to S$90 billion under a legislation known as SINGA (Significant Infrastructure Government Loan Act) to finance major long-term infrastructure such as new train lines and protective measures against rising sea levels.

“This approach will allow us to spread out the lumpy costs of such infrastructure investments more equitably across generations,” he said.

While the carbon tax will remain unchanged at S$5 a ton until 2023 to provide businesses with more certainty in a challenging climate, a review of the tax is underway with results to be announced in 2022’s Budget.

As recurrent expenditure is expected to continue to rise, the government aims to increase revenue by raising the Goods and Services Tax (GST) at some time between 2022 and 2025, subject to the economic outlook.

GST will also be imposed on low-value goods imported by air or postal service to ensure a level-playing field for local businesses.

“Without the GST rate increase, we will not be able to meet our rising recurrent needs, in particular healthcare spending,” said Heng, acknowledging the unpopularity of tax increases.

“While we are fortunate to be able to tap on our reserves to respond to the COVID-19 crisis, it is not tenable for the government to run persistent budget deficits outside periods of crisis.”

Furthermore, Heng stated that should the Base Erosion and Profit Shifting, or BEPS 2.0 project, result in changes to international tax rules, adjustments to Singapore’s corporate tax system would be considered in consultation with stakeholders.

Heng also provided extensive support measures for families and workers, including incentives for individuals and corporations to donate to charity, after having noted that overall charity donations had fallen in 2020.

The current tax deduction of 250 per cent for charitable donations to Institutions of Public Character (IPCs) will be extended to end 2023.

Closing his budget speech, Heng said that based on the current outlook, he expects that as Singapore’s economy recovers, the government’s Budget will be able to support projected expenditure for the measures taken.

“Let us continue to focus on what lies ahead and chart a clear direction forward,” he said.

“To secure our future, it is crucial for us to seize opportunities in new growth engines, respond to structural trends, and transform our economy.”