Loading component...

At a glance

The huge levels of government support injected into Australia’s economy from March could only limit the negative fallout from the pandemic, not keep Australia out of recession.

The Outlook forecasts that Australia’s economy will shrink 2.25 per cent in 2020/21. If looking at the 2020 calendar year, the government is forecasting a 3.75 per cent contraction in economic activity, before rising 2.5 per cent in 2021.

The government forecasts that the unemployment rate will increase to 8.75 per cent in 2020/21 from 7.4 per cent in June 2020 (forecasting that unemployment will peak at 9.25 per cent in December).

The government states that unemployment would have been much higher without support measures such as the JobKeeper wage subsidy. It estimates that such payments prevented around 700,000 additional job losses, which would have equated to an unemployment rate around five percentage points higher than the current rate.

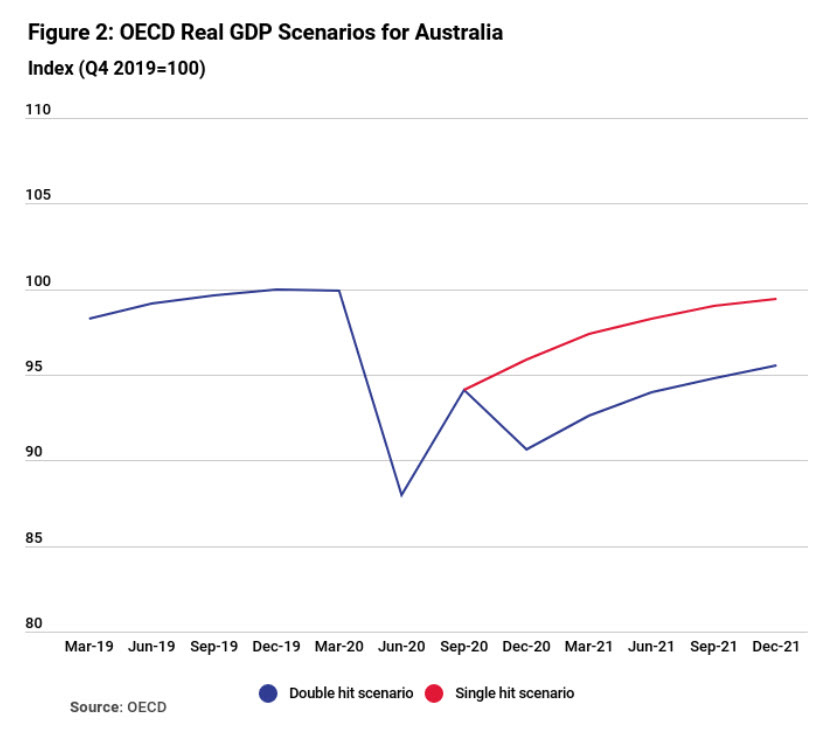

However, others have a more pessimistic outlook. The OECD recently forecast that Australia’s economy will shrink 5 per cent in 2020 (in a best case scenario of a single wave of COVID-19 infections), or decline 6.3 per cent if there is a second wave of infections.In this double-hit scenario, the OECD is forecasting the economy will grow only 1 per cent in 2021.

The OECD stated that consumption in Australia will be tempered due to ’lost earnings, higher unemployment levels and ongoing caution,” while ”reduced demand, more fragile finances and uncertainty” will weigh on business investment.

On the level of unemployment benefits and the environment, the OECD stated that ”the authorities should also ensure that the social safety net is adequate and consider further investment in energy efficiency improvements.”

For those looking to do some scenario analysis for budgeting purposes, CEDA, in its Macroeconomic Policy: avoiding the cliff report (see page 7) has produced the following chart showing how single wave and second wave scenarios may impact Australia’s economy:

Under the scenario where Australia experiences a second wave of infections, the economy does not return to where it was in December 2019 until some time in 2022, at the earliest.

Globally, the Australian Treasury is forecasting that:

- China will grow 1.75 per cent in 2020 and 8.25 per cent in 2021

- US will shrink 8.0 per cent in 2020 and grow 4.75 per cent in 2021

- Japan will shrink 6.25 per cent in 2020 and grow 2.75 per cent in 2021

- India will shrink 4 per cent in 2020 and grow 4.25 per cent in 2021

- The euro area will shrink 8.75 per cent in 2020 and grow 5 per cent in 2021.

In other economic forecasts, the government is expecting wages growth to be very low in 2020/21 at 1.25 per cent in 200/21, the same rate as inflation, meaning real wages growth will be zero.

Fiscal outlook

The government states that it has provide A$289 billion in fiscal and balance sheet measures to the economy, which is equivalent to around 14.6 per cent of GDP. Fiscal support includes the JobKeeper wage subsidy, the JobSeeker Bonus Payment and the Cash Flow Boost.

Balance sheet measures include the SME bank loan guarantee scheme. The direct fiscal support amounts to around 9 per cent of GDP, one of the larger packages of all countries

This large spending will have a significant impact on the nation’s finances, with the underlying deficit expected to be A$85.8 billion in 2019-20 or 4.3 per cent of GDP. In 2020-21, the deficit is expected to grow to A$184.5 billion or 9.7 per cent of GDP.

Australia’s net debt is expected to grow from A$373.6 billion in 2018-19, to A$488.2 billion in 2019-20 and A$677.1 billion in 2020-21. However, as a percentage of GDP, the net debt (35.7 per cent of GDP in 2020-21) is still low against many other advanced economies, giving the government the “fiscal space” to do more if required.

While Australia’s fiscal deficit and debt has “ballooned”, the OECD stated that ”Australia’s ample fiscal space permits a strong response to a second outbreak.” It suggested that expanded ”loan guarantees, coupled with accelerated insolvency processes, could reduce scarring for entrepreneurs and facilitate a more dynamic recovery.”

Policy announcements

Most of the tax and superannuation measures announced in the update have previously been announced or implemented. More recent announcements include:

The extension to JobKeeper wage subsidy

The JobKeeper payment, which was originally legislated to expire on 27 September 2020 will continue to be available to eligible businesses and not-for-profits until 28 March 2021.

The payment rate will be reduced from $1500 per fortnight for eligible employees and business participants to $1200 per fortnight from 28 September 2020 and to $1000 per fortnight from 4 January 2021.

From 28 September 2020, lower payment rates will apply for employees and business participants who worked fewer than 20 hours per week.

From 28 September 2020, businesses and not-for-profits will be required to reassess their eligibility with reference to their actual GST turnover in the June and September quarters 2020. They will need to demonstrate that they have met the relevant decline in turnover test in both of those quarters to be eligible for the JobKeeper Payment from 28 September 2020 to 3 January 2021.

COVID-19 SME Guarantee Scheme extended

The Coronavirus SME Guarantee Scheme has been implemented to assist small and medium enterprises (SMEs) impacted by COVID-19 to access working capital. The scheme will be extended from 30 September 2020 to loans written until 30 June 2021.

Under the Scheme, the Australian Government will provide a guarantee of 50 per cent on new loans issued by eligible lenders to SMEs.

Application period extended for temporary early access to superannuation

The government has allowed individuals affected by the financial impacts of COVID-19 to access up to $10,000 of their superannuation in the 2019/20 income year and a further $10,000 in the 2020/21 income year on a tax-free basis.

The application period for the 2020/21 income year will be extended from 24 September 2020 to 31 December 2020.

Apprentice and trainee wage subsidy expanded

The Supporting Apprentices and Trainees wage subsidy will be expanded. The initial wage subsidy provided small business employers with 50 per cent of an apprentice or trainee’s wages for nine months, capped at A$7000 per quarter.

The subsidy, due to end on 30 September 2020, will be extended to 31 March 2021 and will be expanded to include medium-sized businesses from 1 July 2020.