Loading component...

At a glance

- Women have been making steady inroads into accountancy and finance, but there is still much work to be done to achieve equity in career advancement and pay.

- Across the finance sector, the gender pay gap is higher than in any other industry at 27.5 per cent, and women hold only 28.7 per cent of senior management roles.

- A significant portion of the pay gap can be attributed to women taking breaks from their career for parental leave and other carer responsibilities.

In 2017, Johanna Platt CPA came close to walking away from a dream job opportunity.

She had just stepped into the elevator at Vanguard Investment Australia and was heading to her interview for the role of CFO when she came face to face with the classic C-suite stereotype – a man in a pinstriped suit.

“I almost turned around and walked out,” laughs Platt, who landed the CFO job at Vanguard, despite the initial self-doubt.

“I felt intimidated, but that was more my perception. It was nothing like that on the inside.”

If seeing is believing, however, it is little wonder many women have struggled to picture themselves in senior leadership roles.

This is especially the case in industries like accounting, where in Australia women hold only 32.5% of management positions, according to data from the Workplace Gender Equality Agency (WGEA).

Across finance more broadly, where the gender pay gap is the greatest of any industry at 27.5 per cent, women hold only 28.7 per cent of key senior management roles.

"I think the other challenge that we're up against in years and years of gender norms and unconscious bias that play out from a very early age. Research shows us that girls start discounting themselves from certain jobs at age seven."

Women have been chipping away at the “glass ceiling” for decades and, as leaders like Platt illustrate, cracks have certainly emerged. She had few female role models on her way to the top, but notes a significant change in what she says is often regarded as “a conservative, closed male-dominated industry”.

“I can see a big change in the modern workplace,” says Platt.

The question is whether the pace of change is fast enough. What barriers do women continue to face in finance and accounting – both in entering the profession and progressing within it – and what will it take to even the scales?

Early start

Opportunities for women in accounting and finance are often determined well before they finish high school. Kate Bushell, founder and director of social enterprise Girls of Impact, says she still hears of teachers discouraging girls from selecting subjects in maths, science or technology.

“It just astounds me that it’s still happening,” she says. “But I think the other challenge that we’re up against is years and years of gender norms and unconscious bias that play out from a very early age. Research shows us that girls start discounting themselves from certain jobs at age seven.”

Girls of Impact works primarily with students in grades 9 and 10, where it aims to influence subject selections that can directly affect future career choices.

“We can still do a lot of myth-busting in that age group to influence them into thinking much more broadly,” says Bushell. Girls of Impact recently teamed up with industry superannuation fund HESTA on a project aimed at encouraging more young women to consider a career in financial services.

“Girls don’t see enough of themselves in these spaces, and that’s the overarching issue that we have with girls discounting themselves from finance and financial services,” says Bushell.

For finance leaders like Caroline Pauley CPA, executive director institutional Australia at ANZ Bank, there were few female role models in her industry to aspire to.

“I didn’t realise until well into my career the importance of informal mentoring and sponsorship,” she says. “That was always a mystery to me. Now I participate in mentoring programs, and I mentor many people at the bank informally, and it’s been a great way to connect to a whole range of different people.”

The (under) value of caring

A recent Women’s Ambition Report from Women’s Agenda has found women are indeed ambitious – they want to earn more money (37 per cent) and get promotions (30 per cent) – but many who have taken career breaks are not optimistic about their return-to-work options.

Bianca Hartge-Hazelman, founder and CEO of Financy, an organisation that seeks to improve financial capability and economic wellbeing of women, says that while women continue to carry the majority of undervalued caring responsibilities, they will continue to face career barriers.

“Even when you look at paid plus unpaid work, women are still doing above and beyond in total hours of work,” she says. “And a large proportion of that is unpaid work.

“That is really disappointing, because what we know about unpaid work is that time spent in care, which is very valuable, is unfortunately undervalued from a financial point of view.

“This can act as a barrier to your own financial progress, to realising your full potential and to realising the big vision of economic gender equality.”

On a positive note, the accounting and finance profession in Australia offers above-average paid carers’ leave. WGEA director Mary Wooldridge says that about 77 per cent of businesses in the sector offer paid carer’s leave. This compares to the Australian business-wide average of 52 per cent.

“We find that companies that offer paid parental leave dramatically increase the likelihood that women will then return to the business and continue on in that career,” she says.

Commitment from the top

Women in Australia have been graduating from university in greater numbers than men for more than a decade. However, many employers claim it is tough to find suitably qualified women for senior roles.

“My message is to look harder,” says Hartge-Hazelman. “The pipeline, however, is an issue. There is a role for not only organisations, but also for universities in the way they promote management, commerce and MBA programs.”

However, qualifications are not enough to overcome structural biases.

Researchers at the University of California, Berkeley have found that when it comes to MBA graduates, men were almost immediately given larger teams to supervise and that this meant they were awarded higher salaries than women with the same qualifications.

“We are seeing a gender pay gap already existing out of the blocks for MBA graduates,” says Hartge-Hazelman. “There’s things that we need to change in terms of gender bias, along with ways to assist the pipeline growth for women.”

Gender diversity in leadership can’t happen without buy-in from the CEO, the board and the broader executive team. Belinda Shaw FCPA, general manager finance with Sydney Airport, says leaders must put words into action.

"One of the things we recommend is that companies perfer, a gender pay gap audit, so they can understand where those discrepancies are and where there are blockages in the pipeline or any other issues."

“Companies need to continue to make it a priority to hire, support and promote women to leadership roles,” she says.

Wooldridge says a commitment to diversity should be “seen as a business challenge and part of a broader business plan”.

“We’ve done the work that shows the causal relationship between more diversity at senior levels and increased profitability and productivity,” she says.

“One of the things that we recommend is that companies perform a gender pay gap audit, so they can understand where those discrepancies are and where there are blockages in the pipeline or any other issues.”

Wooldridge notes that about 75 per cent of businesses in the accounting and finance industries have conducted gender pay gap audits, which is significantly higher than the average overall.

“In accounting, about half of those who conducted the audit did something about it,” she says. “For finance, 80 per cent have taken action as a result. That is a credit to the finance industry, because the average is just over 50 per cent.”

WGEA calculates it will take 26 years to close the gender pay gap.

“What underlies a lot of this is very rigid gender stereotypes in terms of roles and promotion and opportunities,” says Wooldridge. “This type of long-term culture isn’t straightforward to shift, but certainly it can be done with leadership and commitment and transparency and targets.”

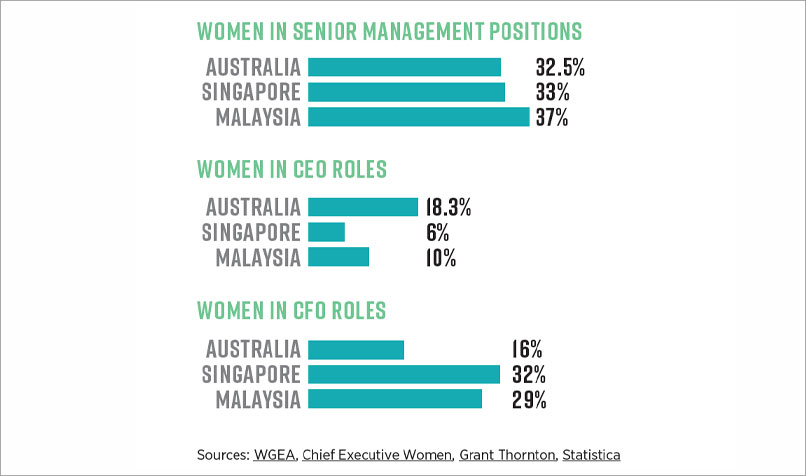

Women in key decision-making roles in the Asia-Pacific

Adding up the gender pay gap

Australia’s national gender pay gap is 14.2 per cent. Research from WGEA, in partnership with KPMG, shows the causes of the gender pay gap are grouped into three key areas:

17% industrial and occupational segregation

“This is less relevant to the finance sector, because it is not highly feminised or masculinised,” says Wooldridge. “Although, aspects of the businesses within the overall industry certainly can be.”

39% career breaks

Wooldridge notes that women taking breaks in their career, particularly for parental leave, but also for other caring responsibilities, account for a significant portion of the gender pay gap.

39% bias and discrimination

“Graduate surveys show that men get paid more than women straight out of university, and this continues all the way through their careers,” says Wooldridge.

Caroline Pauley CPA

Executive director Institutional Australia, ANZ Bank

Caroline Pauley has worked in financial services since the mid-1990s. She joined ANZ as business banking relationship manager in 2007 and says her career path hasn’t been a direct climb up the corporate ladder. “I’ve taken steps to the side, I’ve changed roles, I’ve challenged myself,” she says, and advises other women to do the same.

Career trajectory: “I made a choice very early on to pursue a career in finance. I wanted to use my technical skills in a broad way, and I wanted to have access to a diversity of roles and experiences. I really felt that coming into finance and banking would be the best way to do that.”

Career highlights: “When I think about the best moments in my career, they’ve always involved people, whether that’s doing really well in a project with a client, having success in a team, or leading a team and achieving a really great financial goal.”

Obstacles to overcome: “Being the only female in the room was certainly an experience in the earliest stages of my career, but companies have now got great policies on diversity and flexibility, and ANZ also has great diversity policies in recruitment. I think it’s important that leaders enact and bring those policies to life. Improving diversity won’t happen unless leaders make changes.”

Advice for emerging female leaders in finance: “Develop breadth in your skills and engage with people around you who value excellence, as they really lift the bar and drive determination and best practice. They are the people you want to be around and observe and learn from. Whether they are male or female, it doesn’t really matter.”

Johanna Platt CPA

CFO, Vanguard Investments Australia

Joanna Platt CPA joined Vanguard as CFO in 2017. She describes her career path as “unconventional”, having worked in engineering before moving into finance. Male-dominated work environments were commonplace early in her career, but she is upbeat about the pace of change.

Career trajectory: “I studied chemical engineering at university, which was a very male-dominated environment. When I started working in industry, I was drawn more to the analytical problem-solving side, and that started me on the path of business analysis and financial planning. I complemented that along the way with an MBA and then the CPA Program.”

Career highlights: “Joining Vanguard was a huge highlight for me, as I was able to jump into financial services when I didn’t have that industry background. It really showed the benefits of having the confidence to back yourself. Also, it showed that my qualities of leadership are more universal and transferrable.

Obstacles to overcome: “When I cast my mind back 20 years ago, the main obstacle I encountered is lack of role models. What is wonderful today is we see many more females in leadership roles.”

Advice for emerging female leaders in finance: “There’s a statistic that if a male sees a job description, if they meet 60 per cent of the criteria, they’ll apply for the role, whereas women feel they have to be closer to 100 per cent. I say, go with 80 per cent – stretch yourself and be resilient to take those opportunities. There will be knock-backs – I’ve had plenty – but you need to be resilient.”

Belinda Shaw FCPA

General manager finance, Sydney Airport

Belinda Shaw FCPA joined Sydney Airport in 2019, after more than 15 years in senior finance roles at GE. When asked to describe great leadership in three words, she nominates “inspirational, creative and humble”.

Career trajectory: “I was always interested in accounting and started my career in an accounting firm, but I felt like it wasn’t the perfect fit. I joined General Motors Holden while I was completing the CPA Program, and it was here that I found a love for broader finance roles and saw the partnership and impact that the finance team could have on business performance.”

Career highlights: “It’s hard to not nominate the past 18 months of working through COVID-19 at one of the biggest and most impacted airports in Australia. During that time, I have been helping to lead many areas, including reducing our cost base, organisational restructuring, raising A$2 billion of equity, as well as leading our response to a takeover bid. I often joke that I am working in a live Harvard business case. The workload has been intense, but the learnings have really stretched me.”

Obstacles to overcome: “Whenever I have come across obstacles, I have always spent time seeking out advice from people I trust to challenge my thinking or provide other perspectives. I’ve found that a solid network of trusted advisers is invaluable.”

Advice for emerging female leaders in finance: “Try to find a company that invests in its people, and hunt for that leader who will push you outside your comfort areas and care about your career journey.”