Loading component...

At a glance

By Nigel Bowen

Not so long ago, it seemed like crypto had finally been accepted as a volatile but bona fide asset class.

Prominent sceptics, such as Ray Dalio, had changed their tune. Millennials despairing of ever getting a foot on the property ladder were fantasising about getting rich quick by buying low and – within months, weeks or days – selling high.

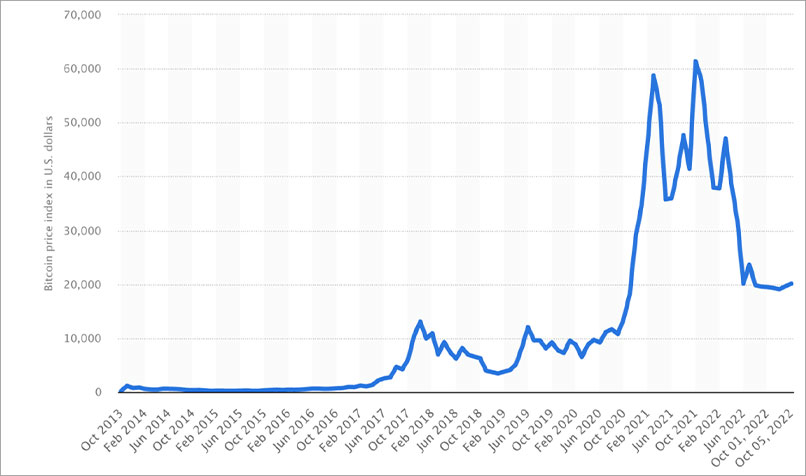

In mid-November 2021, a single Bitcoin would set you back more than US$68,000 (A$107,500, given the current exchange rate).

Then, as is its habit, Bitcoin crashed.

“Crypto Winter” descended and wiped US$2 trillion (A$1.54 trillion) off the value of the crypto market. At the time of writing, it’s unclear whether “Crypto Summer” will ever arrive.

It’s also unclear whether crypto will continue its journey to mainstream respectability and become correlated to other asset classes.

Bitcoin (BTC) price per day from October 2013 to October 20, 2022 (in U.S. dollars)

A brief history of Bitcoin

Bitcoin first started being used for online transactions in 2011. However, it didn’t begin to cross over into the mainstream and start skyrocketing in value until 2017.

That’s when a sizeable number of retail investors started investing in cryptocurrencies. This was also when speculation began to mount about Bitcoin becoming correlated with other asset classes, particularly shares and gold.

Bitcoin started heading skyward again when, thanks to lockdowns, many people found themselves with time on their hands and government payments in their bank accounts.

While remaining volatile, the price of Bitcoin hit historic highs from late 2021 to early 2022, and then began a steep decline.

Was crypto the canary in the coalmine?

Just as share markets and property markets did, crypto markets boomed throughout 2020-2021.

Crypto prices started tanking in early 2022, around the same time tech shares went off the boil. Shortly thereafter, share markets and property markets also started sharply declining.

What exactly does that mean and what should regulators do about it?

Dr Jana Schmitz ASA, CPA Australia’s digital economy policy lead, argues that rumours of the death of cryptocurrencies have, yet again, been greatly exaggerated.

Yet, with some major economies likely to slip into recession (although moderate) in the coming months and ongoing geopolitical tension, she suspects most investors will now want to steer clear of riskier asset classes.

“Crypto is a new asset class, so there just isn’t the historical data available to make confident predictions about what will happen in the event of an economic downturn or war,” Dr Schmitz says.

“But I’d be surprised to see the price of cryptocurrencies rising significantly any time soon.”

Dr Schmitz is hesitant to buy into the debate over how correlated cryptocurrencies have been or will become with other asset classes.

“I wouldn’t go so far as to claim tech shares and crypto are correlated, but there would appear to be some overlap there,” she offers.

“Tech industry leaders such as Elon Musk have long been cheerleaders for cryptocurrencies. Plus, the type of investor willing to put their money into high-risk, high-return tech shares is the same sort of investor likely to invest in Dogecoin.”

Dr Schmitz argues crypto isn’t correlated with shares, bonds, cash, real estate or even gold.

“Greater interconnection between the crypto market and the traditional financial markets may develop in the future, which is presumably one of the reasons regulators have started paying more attention to digital assets,” she says.

“But, despite regular claims to the contrary, there isn’t much evidence of correlation at this point.”

Cryptocurrency 2.0

One prediction that Dr Schmitz is happy to make is that the “Wild West” days of crypto are ending.

Regulators in Australia and other countries are now looking to better protect the interests of investors, businesses and the public.

“Many crypto businesses support regulation, which may be surprising to some”, she says.

“That’s because they know that investors, particularly institutional investors, require more regulatory certainty before buying into the crypto market”.

“I’ve written about how CPA Australia advocates for a regulatory regime that will encourage innovation,” she says.

“But consumers need to be protected. We can’t continue to have crypto exchanges collapsing and leaving their investors with little or no recourse, just like we can’t have ‘finfluencers’ who aren’t appropriately certified encouraging their followers to buy cryptocurrencies.

Plus, more guardrails are needed to prevent crypto from being used in criminal activities.”

Crypto markets are global, and Australian regulators will likely follow the lead of their counterparts in the US and the EU.

CPA Australia has called on Australian financial regulators, including the Australian Securities and Investments Commission and the Treasury, to define what crypto assets are, how they work and how existing regulation applies to them.

CPA Australia supports the intention of Treasury’s token mapping exercise, but notes that ideally, due to the “borderless” nature of crypto assets, any kind of standards, frameworks or regulation should be harmonised, meaning that the same rules apply across different jurisdictions.

“The Financial Stability Board is currently consulting on its proposed framework for the international regulation of crypto-asset activities,” Dr Schmitz says. “This is a move into the right direction.”

As Jim Chalmers, the Australian Treasurer, has observed, “Australians are experiencing a digital revolution across all sectors of the economy, but regulation is struggling to keep pace … Treasury will prioritise ‘token mapping’ work in 2022, which will help identify how crypto assets and related services should be regulated.”

“Crypto isn’t going away,” Dr Schmitz says.

“In fact, central banks, including Australia’s, are looking into creating Central Bank Digital Currencies, which promise to combine the upsides of fiat currencies and crypto.

“Soon, cryptocurrencies will be seen as, and regulated like, just another asset class.”