Loading component...

At a glance

With the Financial Services Royal Commission in full swing, there has probably never been a worse time since the global financial crisis (GFC) for practitioners to tell clients they are increasing fees.

However, sometimes there are very good reasons (operating costs, more staff, prices aren’t equal to services) for putting up fees – even though nobody is going to like it. For practitioners, justifying the reasons for a rise is paramount because if you can’t, some clients will run straight to competitors. The outcome often depends on how a fee increase is communicated – and whether it is perceived as credible.

Some practitioners talk about the importance of getting the engagement letter right at the beginning, so as to enable increased fees.

CPA Australia’s Josephine Haste CPA, Policy Adviser for Ethics and Professional Standards and Manager for Quality Review Education, is of the view that while the engagement letter must include references to fee structures (APES 305 Para 4.8), it is most important that the firm is able to communicate a value proposition to retain clients.

“It is inevitable that accountants will need to increase their charge-out rates from time to time to cover rising costs and maintain profitability,” Haste says.

“Clients will be more willing to accept cost increases if they fully understand the value proposition being offered by the practice.

“The engagement letter can include a standard paragraph to alert the client to the fact that fees will change at some point in time, ultimately preparing the client for a future increase. Problems can arise when the engagement letter is out of date and not reflective of the services offered to the client.

“It can be difficult to justify a rate increase when the client does not recall the quantum of services being provided by their accountant. CPA Australia’s quality review program notes one of the most common breaches of APES 305 Terms of Engagement, is that the engagement letter has not changed with the introduction or reduction of services being performed for the client.”

According to Haste, it can be helpful to view fee increases in a way similar to any other strategic initiative by the practice. She says careful consideration should be given to what the practice wants to achieve with each client when considering changes to fee structures.

Prices will never go down – only up

In other words, Benjamin Franklin’s famous quote, “Nothing can be said to be certain, except death and taxes”, might have been only partially right. Another certainty is that prices will always go up.

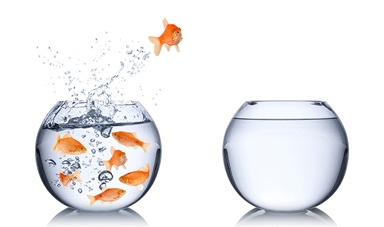

For truly price-conscious clients, a price increase could well send them packing. Equally, as your business grows, it can mean outgrowing clients who can no longer afford your rates. The very last thing you want is to drag your practice into is an unsustainable price war with a competitor.

Another option, of course, is not to increase fees for existing clients at all. Instead, simply quote a slightly higher price to each new client until your prices are where you want them to be.

In a business-to-business context, it can be helpful to remember that loyal, lucrative customers have probably had the same discussions with their own customers and will – quite rightly – expect to be informed well in advance when a fee change is coming.

Regardless, Knight Partners principal Peter Knight FCPA says most clients really don’t care if your costs go up: “They only obsess on the impact it has on them.”

“If you have had the same clients – sometimes for many years – and still provide the same services, in my experience it is almost impossible to justify charging more,” Knight declares.

The importance of value-adding

The solution, he maintains, is to value-add. “We need to be able to introduce incremental services that are easy add-ons, such as advisory annual strategic forward-planning meetings to discuss the performance and goals of our clients’ businesses.”

By that, he doesn’t mean relying on electronic services such as DocuSign at tax time.

“In accountancy, many [practitioners] still don’t have the skillsets to offer full-on advisory services, and until that is embraced – meaning a whole new learning process – if they aren’t hungry for more work there will be push back in terms of putting up fees or, sometimes, just maintaining the fees they already have,” Knight says.

This doesn’t imply becoming another Bain & Company, “but I do think there are quality add-ons to our more traditional services that are not only achievable, but which most of us can do to increase the value of the services we already offer clients,” Knight says.

If you have a sound reputation and record with your most valued clients, certainly emphasise that the price increase has been carefully thought through and is only being taken to ensure continued quality.

Having “been there and done that” themselves, they might well appreciate when you are upfront and take the time to explain why you need to change a fee structure, when it will take effect, and precisely how it will impact clients.

Ultimately, these are the key questions on all customers’ minds when prices go up. Also, the majority of business owners know that prices will always go up, and probably expect that after providing the best service you can at the most competitive fees, your firm will at some point be forced to do the same.

Avoid emailing about a fee increase

Whatever the case, Ilise Benun of US-based Marketing Mentor and author of several books including The Creative Professional’s Guide to Money, warns: “Never tell a client by email you’re raising your rates. This conversation requires that you speak with them in real time, on the phone or in person, so you can be there for their reaction and respond accordingly. Also, be sure to give them a reason for the price increase.”

Remember, it should be a conversation, not a confrontation, and email – although sometimes useful as a means to flag an impending price rise – does not always facilitate a constructive exchange.

Instead, show that you care about what clients think by proactively seeking their input. Consult with your top-tier clients about why your business needs increased revenue, and how perhaps they tackled the same types of issues while remaining fair to their client base.

If emailing clients becomes absolutely essential to inform clients of a price hike, at the very least make sure it is not a generic message. Make them feel that it is personally addressed to them and specifically refers to their individual financial needs.

As a smaller public practice, it is only natural to feel nervous about communicating a price rise and in some cases even become reluctant to have the conversation at all – especially with clients that might account for a large slice of your profitability.

Pre-prepare for hard questions

Therefore, no matter how overworked or understaffed you may be, it is imperative that before talking to customers about a price rise, be prepared in advance. A good idea might be to write down the key reasons for a rise, and by putting yourself in the shoes of your customers, to carefully consider how you intend to respond to any potential objections that might arise.

As Knight notes: “To successfully cross-sell – let alone up-sell – you first need to up-skill.”